Key takeaways

- China’s bond market currently stands at renminbi (RMB) 140.26 trillion1 (circa USD 19.7 trillion) , making it the world’s second largest bond market and arguably one that is too large to ignore.

- Market liberalisation, improved liquidity and its inclusion in global bond indices have increased foreign participation over recent years.

- Historically, this asset class has offered relatively favourable risk-adjusted returns, lower correlation to traditional asset classes and hence a level of diversification.

Market size second only to the US

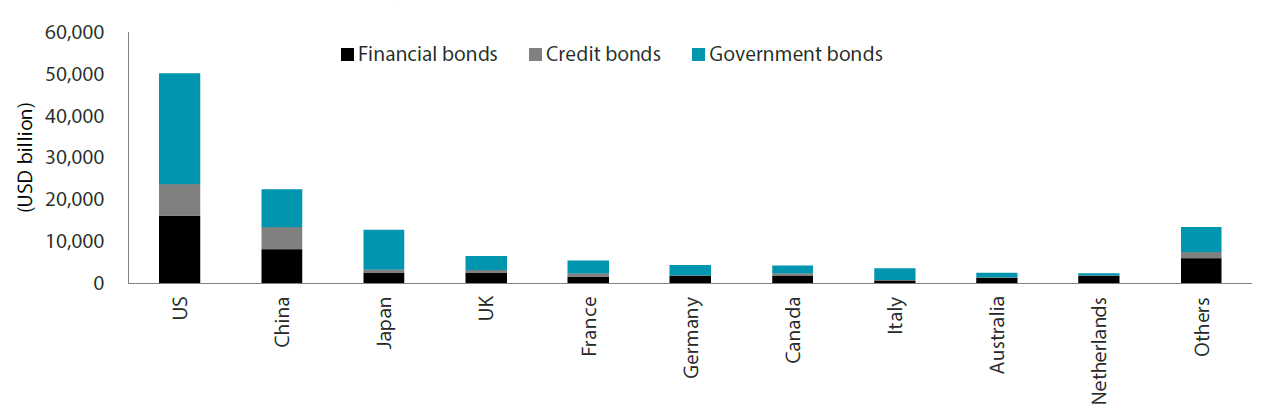

China’s bond market1 has grown substantially and although it remains smaller than that of the US, it is significantly larger than other major bond markets, as illustrated in Chart 1. China’s bond market is larger than those of Japan and the UK and exceeds the combined size of the German and French markets.

Chart 1: Global bonds outstanding by market

Source: BIS, Standard Chartered Research as at December 2021

Source: BIS, Standard Chartered Research as at December 2021

1 As at 30 September 2022

Breakdown of the China bond market

China’s bond market comprises of the following sectors:

- Onshore yuan (CNY) bonds

- Offshore US dollar (USD) bonds

- Offshore yuan (CNH) bonds (Dim sum bonds)

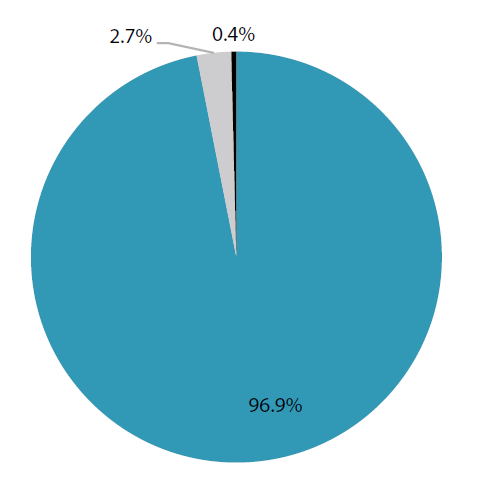

Foreign investment in the China bond market has primarily been allocated to offshore markets. Hence, many overseas investors are somewhat familiar with offshore dollar and Dim Sum bonds which have traditionally been easily accessible. However, it is important to note that the offshore market is but a small fraction of China’s overall bond market. Chart 2 illustrates the massive size of the onshore bond market vis-à-vis the offshore bond market, highlighting a world of untapped opportunities for overseas investors.

Chart 2: China’s onshore market dwarfs the rest

Source: BIS, Standard Chartered Research as at December 2021

Source: BIS, Standard Chartered Research as at December 2021

Source: WIND, Bloomberg, JP Morgan as at December 2021

China’s onshore bond market

Unfamiliarity with the onshore bonds has resulted in a reluctance from investors to allocate to this part of the market. Onshore bonds are traded via the interbank and exchange bond market and are broadly broken down into three categories.

1. Rates bonds

- Rates bonds make up about two thirds of the market and consist of the following:

- Chinese government bonds (CGBs): Essentially sovereign bonds that account for around 15-20% of the market.

- Local government bonds (LGBs): Debt issued by provincial or municipal governments (roughly comparable to US states). These bonds are generally considered risk-free by onshore investors but have much less secondary market liquidity than CGBs. They offer a small pickup in yield over sovereigns.

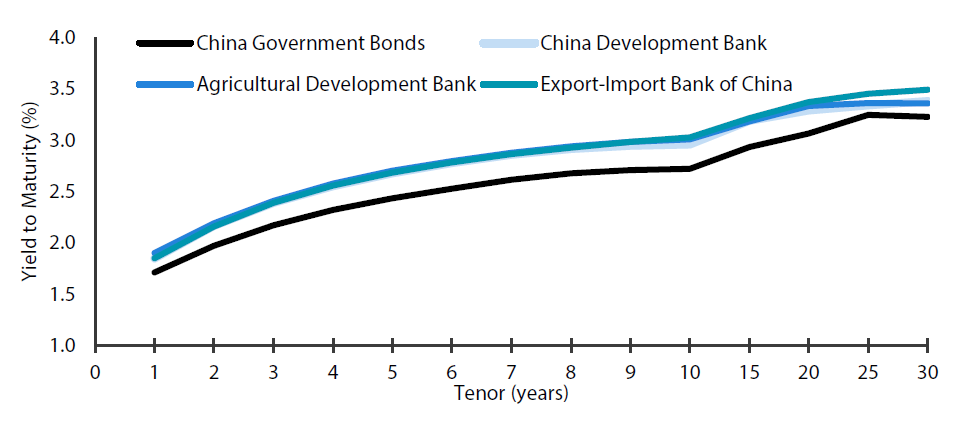

- Policy bank bonds: Debt issued by policy banks, which are state-funded institutions that reach out to areas where private banks might be reluctant to provide lending. They are designed to help channel public sector funding into important areas such as trade, infrastructure and agriculture. Policy banks have a strong policy role set by the China State Council and enjoy implicit sovereign guarantees. Issued by the China Development Bank, the Export-Import Bank of China, and Agricultural Development Bank of China, their credit ratings are rated A+/A1/A+ by S&P/Moody’s/Fitch respectively, which are the same as the sovereign rating. However, policy bank bonds offer yields that are approximately 5-20 basis points higher than CGBs (Chart 3). We believe these spreads are largely due to technical factors such as differences in tax treatment, rather than perceived credit risk by onshore investors.

Chart 3: China government bond vs policy bank bond yield curve

Source: Bloomberg as at 15 August 2022

Source: Bloomberg as at 15 August 2022

2. Money market Instruments

- Around 13% of the China bond market is made up of short-dated instruments issued by financial and non-financial corporates. These include non-convertible debentures, commercial papers and short-term commercial papers and are typically up to one year in tenor. They are generally liquid and provide a small pickup over sovereign bonds which makes them particularly useful for cash management and/or investment by money market funds.

3. Credit bonds

- Credit bonds or corporate debt comprise most of the outstanding bonds in the onshore market. Credit bonds can be issued under the following regulatory framework:

- Mid-term notes (MTNs): Instruments governed by the central bank and require its approval.

- Exchange-listed corporate bonds: Exchange-listed bonds issued by listed companies that are approved by the securities regulator.

- Enterprise bonds: Debt issued by entities that receive approval from the National Development and Reform Commission (NDRC). These bonds are typically one to three years in maturity, with stronger issuers being able to issue 5-year papers. For now, only the biggest SOEs are able to issue longer-dated bonds. Puttable features are common as many local investors prefer shorter duration. This is in contrast to bonds with callable features being more common (than puts) in global fixed income securities.

- Other types include convertible bonds and asset-backed securities. Convertible bonds account for about 0.5% of the market and can be very liquid with high trading volumes, depending on the counter.

CGBs, policy bank bonds and non-convertible debentures issued by national banks are seen as good starting points for investors looking to enter the market. These are highly liquid and are of high credit quality. If slightly lower liquidity is acceptable, bonds of large state-owned corporations provide some pickup in yield. Some of these issuers do have investment grade ratings or have offshore bonds rated by Moody’s/S&P/Fitch.

Opening up of the China onshore market

The onshore bond market has been opening its doors to international investors. Foreign investments into the country were restricted in the past and this has meant that investment in China onshore fixed income has predominantly come from domestic investors. Even just a few years ago, international access to China bonds was only granted to select foreign investors by the Chinese authorities on an approval basis. However, with the authorities increasingly opening up the bond market, foreign investors can now access onshore bonds simply by registering for an access programme, such as the China Interbank Bond Market (CIBM), Bond Connect and Qualified Foreign Institutional Investor (QFII) / Renminbi Qualified Foreign Institutional Investor (RQFII). The easier access is supported by market reforms such as extended trade settlement, flexibility in foreign exchange and extended trading hours which has helped with accessibility.

China bonds are now also included in three major global bond indices (Bloomberg Global Aggregate Index, JP Morgan GBI-EM Index and the FTSE World Government Bond Index) with weights varying between 5 to 10%. Inclusion in the WGBI is a significant development. The WGBI is seen as a developed market bond index and in order for bonds to be included, they need to meet FTSE’s inclusion criteria, such as liquidity requirements, and also achieve a minimum credit quality (A- by S&P and A3 by Moody’s). The inclusion of Chinese bonds into the index lends credibility to this market for global bond investors. It is a significant step in China’s transition towards a mature bond market alongside developed market peers.

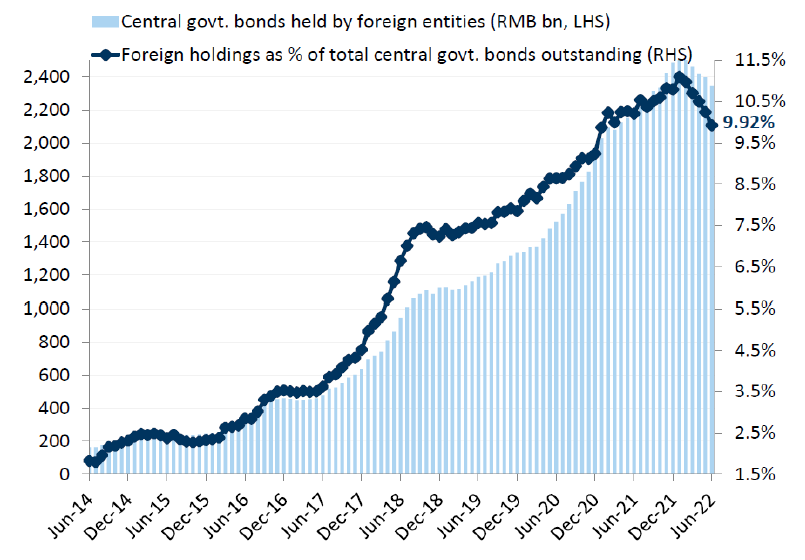

This has enabled asset managers to offer a variety of investment solutions including open-ended funds which allow an easy access route to this important market. Foreign investors have therefore materially increased exposure to China onshore bonds, in particular sovereign bonds. Chart 4 shows foreign ownership of China central government bonds and its upward trend.

Chart 4: Foreign ownership in China central government bonds

Source: Chinabond, SSE, SZSE, Wind, Goldman Sachs Global Investment Research

Source: Chinabond, SSE, SZSE, Wind, Goldman Sachs Global Investment Research

We believe there is plenty of room for further advances and see continued progressive developments in other areas such as the onshore credit market and the opening up of onshore interest rate derivatives. These encouraging advances are expected to further support growth in this asset class.

Investment opportunities

Diversification

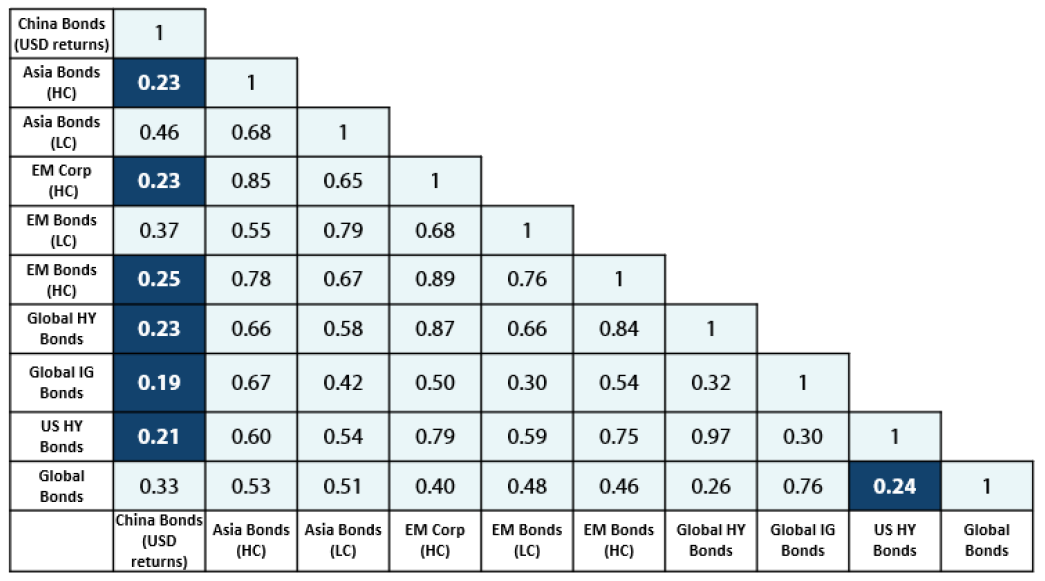

China bonds have a low correlation to other major bond markets including both developed and emerging. As highlighted in Chart 5, historical correlations with key bond markets have been below 0.25. In our view, this is advantageous for achieving good portfolio diversification.

Chart 5: Correlation coefficient of global bond markets2

Source: Bloomberg, August 2012–July 2022

Source: Bloomberg, August 2012–July 2022

The low correlation reflects the sensitivity of the asset class to Chinese domestic economic and policy cycles rather than those of global markets. China has a large domestic economy and therefore its economic cycles may not always be in sync with the rest of the world.

In March 2020, the spread of COVID-19 resulted in heightened market volatility and created challenging bond market liquidity conditions in which not even the US Treasury market was spared. In comparison, the Chinese onshore fixed income market remained calm. This was because of the low foreign investor participation and consequently, local investors were able to easily absorb selling flows.

Although corelations and diversification benefits may weaken as foreign investor participation increases, it will take time for foreign investors to build up a significant presence. Overseas investors currently own less than 10% of Chinese onshore sovereign bonds and less than 5% of the entire onshore bond market. Therefore, we believe that diversification benefits will remain for the foreseeable future.

Historically lower volatility and risk adjusted returns

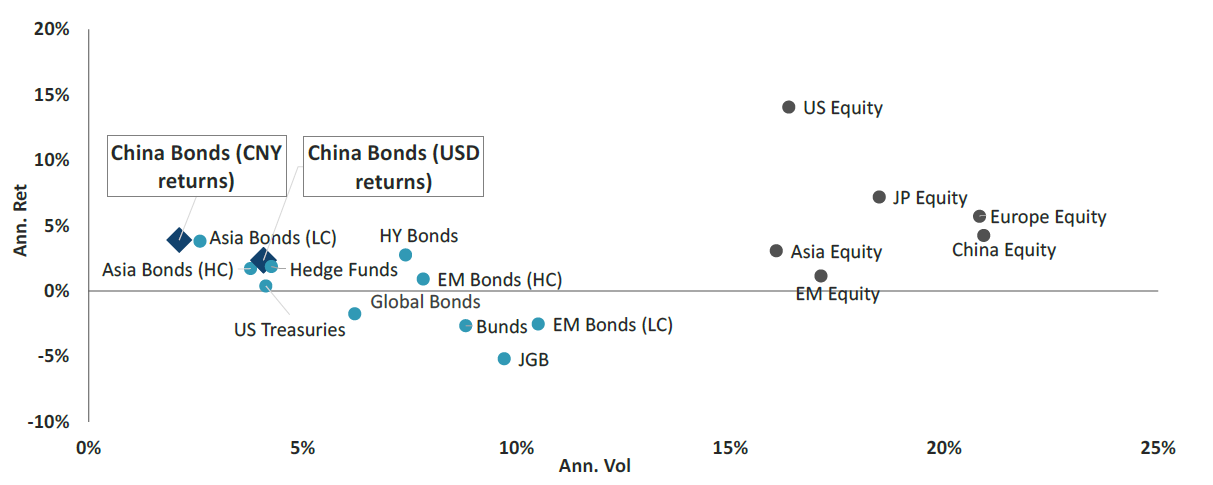

Chinese onshore bonds have typically maintained a lower volatility relative to bonds of other countries. Moreover, China’s central bank has significantly improved its liquidity management so volatility has certainly been reduced. Since 2018 there have been few liquidity squeezes on the onshore fixed income market and they have not reached the magnitude of those that occurred in the years before.

2China Bonds = JPM Jade Broad Diversified China Index, Asia Bonds (HC) = JPM Asia Credit Index, Asia Bonds LC = JPM Jade Broad Diversified, EM Corp (HC) = JPM CEMBI, EM Bonds (LC) = JPM GBI EM Global Diversified, EM Bonds (HC) = JPM EMBI Composite, Global HY Bonds = Bloomberg Global HY Bonds, Global IG Bonds = Bloomberg Global Aggregate, US HY Bonds = Bloomberg US HY Bond, Global Bonds = FTSE World Government Bond Index

China bonds have historically offered relatively competitive returns per unit of volatility versus other major fixed income asset classes. Chart 6 plots the annualised return and annualised volatility of major global asset classes.

Chart 6: 10 Year risk-return profile3

Source: Nikko AM and Bloomberg as at 31 October 2022

Source: Nikko AM and Bloomberg as at 31 October 2022

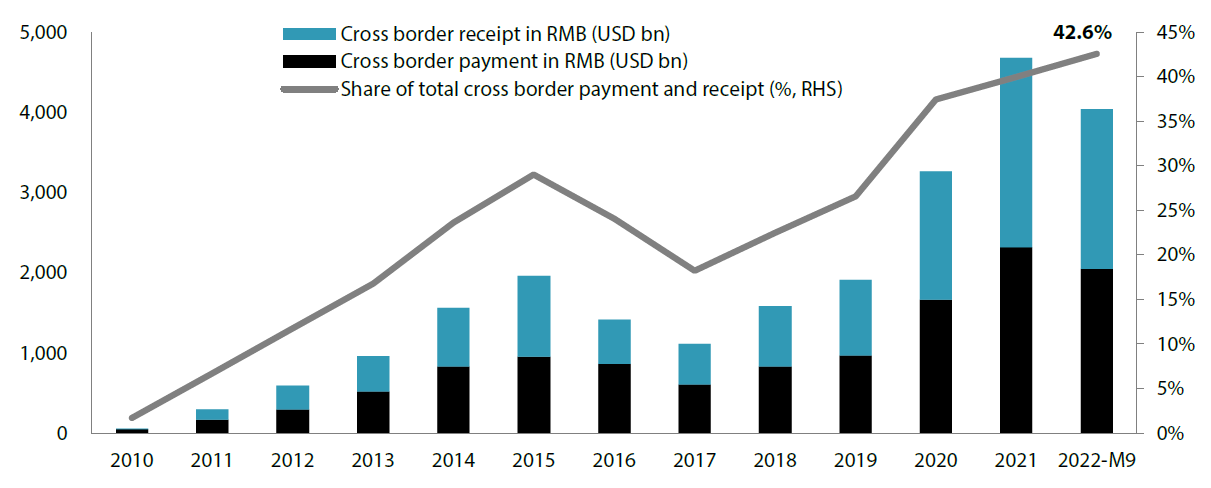

Renminbi’s rising usage globally

The renminbi’s reputation as a major global currency is increasing and this should be beneficial for onshore fixed income. The last decade has seen internationalisation of the currency with rising global usage. China can now settle trade in renminbi with over 100 countries. In addition, 42% of China’s cross border payments and receipts were settled in renminbi in the first nine months of 2022 (Chart 7).

Chart 7: China’s cross border payments and receipts

Source: Wind, Standard Chartered Research as at September 2022

Source: Wind, Standard Chartered Research as at September 2022

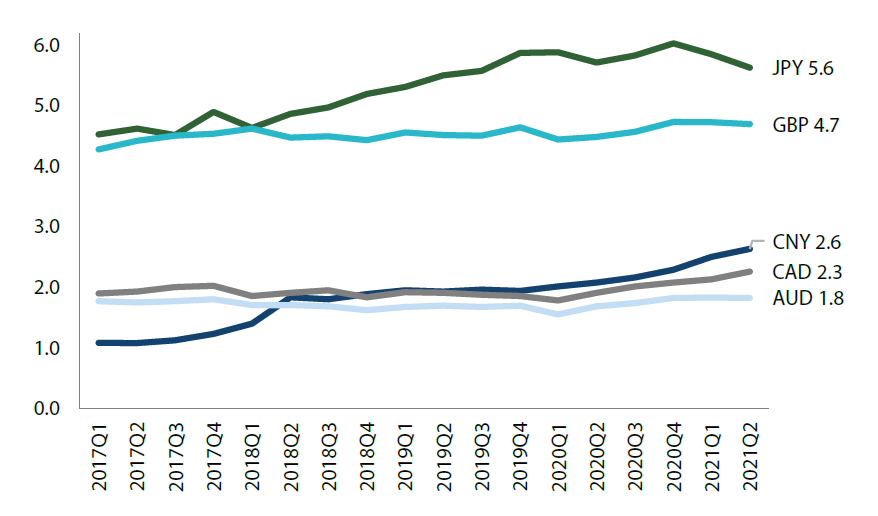

The renminbi is also being held as a reserve currency in more than 70 countries and the trend has been increasing (Chart 8).

Chart 8: Renminbi’s share of allocation in global reserves

Source: IMF, SAFE, Wind, Standard Chartered Research

Source: IMF, SAFE, Wind, Standard Chartered Research

Current renminbi underperformance presents an opportunity

The renminbi has depreciated significantly against the US dollar in 2022, as the US Federal Reserve’s hawkish shift resulted in a dramatic rise in the greenback. China’s balance of payments remain positive, exports are holding up and the country has been posting strong trade surpluses. China is the second largest economy in the world and is a key trading partner for major countries. As such, growth and demand for the currency is unlikely to collapse for the foreseeable future; therefore we believe there is still attractiveness in the renminbi from a long-term perspective.

The People’s Bank of China (PBOC) has the ability to apply various quasi-monetary policy tools including emergency liquidity arrangements to help revive the economy and stimulate the renminbi. We have also seen central banks in Southeast Asia renewing agreements with the PBOC over the last couple of years; this essentially reduces dollar usage in cross-border payments and lessens their reliance and dependence on the dollar. Depreciation risks could be reduced going forward amid expectations that US rate hikes will begin to slow down and with China continuing with its accommodative monetary policy.

Conclusion

Our long-term outlook for China bonds remains positive. We believe that the world’s second largest bond market has plenty of room to grow and ample tailwinds to lead it in this direction. China’s bond market is exhibiting low correlation to other asset classes, displaying historically lower volatility, enjoying continued internationalisation of the renminbi and benefitting from the country being included in globally recognised indices. We therefore believe that the China bond market, which is gaining increased attention worldwide, offers a quality investment opportunity for investors. With the renminbi going through a weak phase, the current market environment could present opportunities for investors with a long-term timeframe.