Global equity investment philosophy

Our philosophy is centred on the search for “Future Quality” in a company. Future Quality companies are those that we believe will attain and sustain high returns on investment. ESG considerations are integral to Future Quality investing as good companies make for good investment. The four pillars we use to assess the Future Quality characteristics of an investment are:

Franchise - does the company have a sustainable competitive advantage?

Management - does the company make sound strategic and capital allocation decisions?

Balance Sheet - is growth appropriately financed?

Valuation - are the company’s prospects under-appreciated by the market?

We believe that investing in Future Quality companies will lead to outperformance over the full market cycle. Our strategy is based on fundamental, bottom-up research therefore sector and country allocations are a function of stock selection. The Global Equity strategy is a concentrated, high conviction portfolio with a high active share ratio.

Market outlook

There have been a lot of headlines in recent days about the inversion of the US yield curve and whether this is an accurate predicter of an impending recession. Whilst a recession is not inevitable in our view, we are increasingly of the view that economic growth is likely to slow materially in coming months, as consumers adjust to rapidly rising costs of human necessities such as food, heat and shelter.

The default response to decelerating growth in recent years has been more liquidity injections by central banks but this looks much less likely this time around with fighting price inflation seen as a more pressing requirement. Federal Reserve Policy Committee members have been lining up to deliver hawkish messages to markets in recent weeks. Whilst it is easy to understand the Fed’s desire to at least be seen to be doing something and rebuild their inflation-fighting credibility in the process, it could well prove easier to “talk the talk” than to “walk the walk” on this one, given elevated debt burdens and the economic impact of increasing the cost of servicing this debt. Furthermore, it is not clear what they can really do to bring down prices quickly. Making borrowing more expensive may dampen speculative demand but will do little to incentivise new food or energy capacity coming onstream. In fact, its effect could be quite the opposite.

The Fed likely has a relatively short window to at least do something. Latest polling data suggests that inflation has become the number one topic that US voters are considering when deciding how to vote in November’s mid-term elections. Raising rates and squeezing standards of living might be OK now, but it will cost the Fed a lot of political capital as we move closer to polling day.

Regardless of the liquidity environment, we will not relax our requirement for rising and sustainable returns. These remain the essential attributes of Future Quality investing. The question is how long do the rising returns have to be sustained for and what does this mean for the areas we should be researching our potential investments? History may point in the right direction, but it is important to be aware of differences that may make historical precedents less insightful.

For instance, unprecedented debt-funded infrastructure investment in China produced a commodity super cycle in the years following 2000 and this (allied to the aftermath of the dotcom bubble) allowed the metals and mining sectors to outperform for seven years. There are certainly similarities today, in terms of the potential structural demand boost for commodities like copper from energy transition and the concentration of equity market performance in the information technology sector in recent years. However, there are some fundamental differences too.

The most major of them are considering how much this pivot to renewable energy will cost (in monetary and resource terms) and—just as importantly—who is going to pay for the necessary investments. Whilst China could effectively fund its spending by issuing debt to itself, such a benign funding mechanism is not obvious for the US or EU after years of quantitative easing and the resultant elevated debt burdens.

Passing the burden onto consumers would be one alternative to state funding, likely via a carbon tax but this too poses some pretty fundamental issues. A World Bank Study confirmed the uncomfortable truth that energy costs a disproportionately high amount to the least affluent in society. Further increasing inequality and fuel poverty would be politically unacceptable in most Western democracies.

The recently launched REPowerEU1 initiative is a good example of the potential disconnect between political ambition and economic reality. The policy’s main ambition is removing European reliance upon Russian energy by 2030. There is little mention, however, of the practical challenges that this entails. How quickly can the new energy infrastructure be planned and delivered? How much additional steel, cement and oil will be needed to build it? How much will it cost? Whilst the glossy Factsheet produced by the EU on this topic has lots of numeric targets for the energy transition that this will necessitate, there is no mention of its resource or financial implications.

We are keen to participate in the push towards a less carbon intensive future but want to do so in a balanced fashion, with one eye on the associated risks. One way of doing this is to prioritise more capital-light businesses who are likely to benefit most quickly from the initial preparations for the switch. Companies whose know-how spans several of the technologies (from carbon capture and storage through to hydrogen and renewable energy) that address carbon reduction are also more attractive than more focused options. Engineering and designing the new energy infrastructure required will comfortably pre-date the actual pouring of new concrete or the laying of new copper cable. As such, these industries are less susceptible to any weakening of political support over time.

The portfolio currently offers a blend of companies that will benefit from the strong imperative to reduce reliance upon carbon intensive sources of energy (and the autocratic regimes that own them) and companies that will benefit from long-term demand growth, as a result of other, more well-established multi-year themes. These include the delivery of high-quality, cost-effective healthcare and the ongoing investment in industrial automation and digitisation. Through investing in these areas, we are confident that we will be able to deliver high and rising returns on investment and that this will feed through into attractive long-term returns for our clients, irrespective of near-term macroeconomic developments or central bank policy.

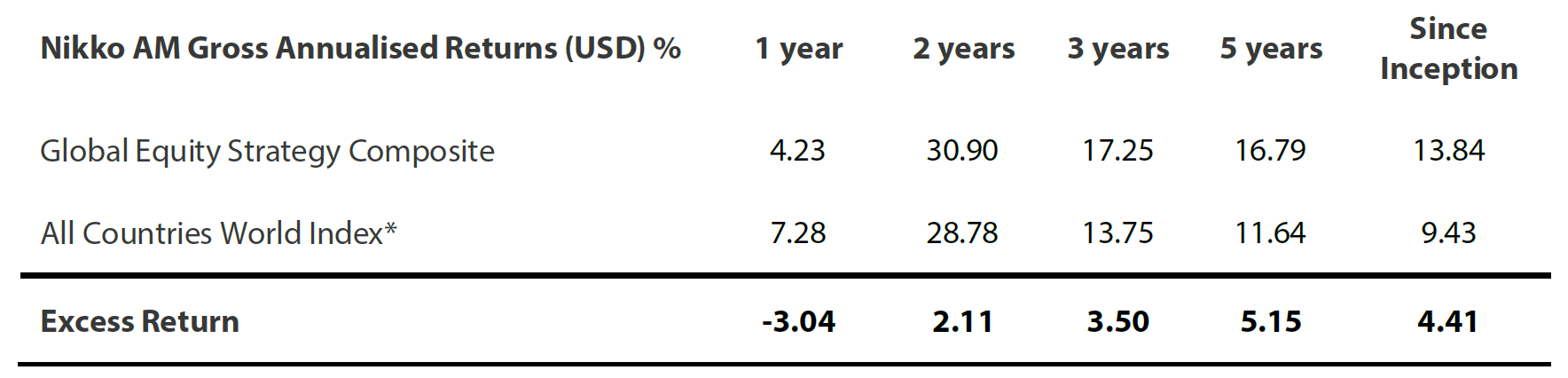

Global Equity Strategy Composite Performance to March 2022

*The benchmark for this composite is MSCI All Countries World Index. The benchmark was the MSCI All Countries World Index ex AU since inception of the composite to 31 March 2016. Inception date for the composite is 01 October 2014. Returns are based on Nikko AM’s (hereafter referred to as the “Firm”) Global Equity Strategy Composite returns. Returns for periods in excess of 1 year are annualised. The Firm claims compliance with the Global Investment Performance Standards (GIPS ®) and has prepared and presented this report in compliance with the GIPS. GIPS® is a registered trademark of CFA Institute. CFA Institute does not endorse or promote this organization, nor does it warrant the accuracy or quality of the content contained herein. Returns are US Dollar based and are calculated gross of advisory and management fees, custodial fees and withholding taxes, but are net of transaction costs and include reinvestment of dividends and interest. Copyright © MSCI Inc. The copyright and intellectual rights to the index displayed above are the sole property of the index provider. Any comparison to a reference index or benchmark may have material inherent limitations and therefore should not be relied upon. To obtain a GIPS Composite Report, please contact This email address is being protected from spambots. You need JavaScript enabled to view it.. Data as of 31 March 2022.

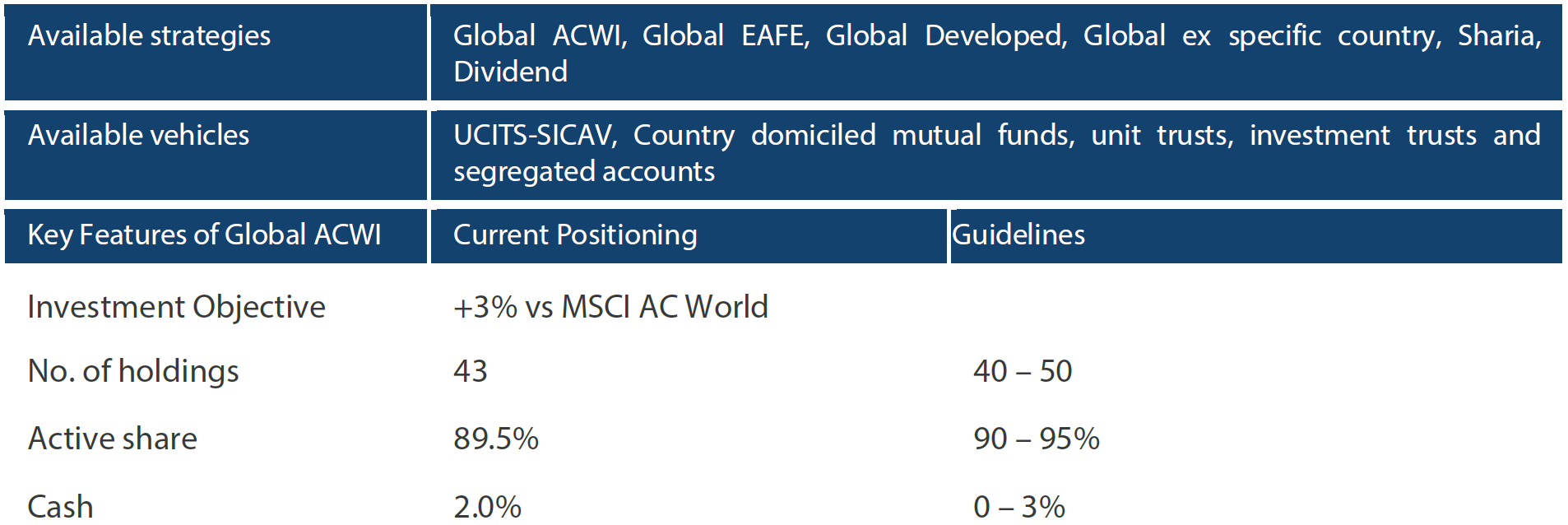

Nikko AM Global Equity: Capability profile and available funds (as at 31 March 2022)

Target return is an expected level of return based on certain assumptions and/or simulations taking into account the strategy’s risk components. There can be no assurance that any stated investment objective, including target return, will be achieved and therefore should not be relied upon. Past performance is not indicative of future performance. This is provided as supplementary information to the performance reports prepared and presented in compliance with the Global Investment Performance Standards (GIPS®). GIPS® is a registered trademark of CFA Institute. Nikko AM Representative Global Equity account. Source: Nikko AM, FactSet.

Nikko AM Global Equity Team

This Edinburgh based team provides solutions for clients seeking global exposure. Their unique approach, a combination of Experience, Future Quality and Execution, means they are continually “joining the dots” across geographies, sectors and companies, to find the opportunities that others simply don’t see.

Experience

Our five portfolio managers have an average of 25 years’ industry experience and have worked together as a Global Equity team for eight years. Two portfolio analysts, Michael Chen and Ellie Stephenson joined in 2019 and are the first in a new generation of talent on the path to becoming portfolio managers. The team’s deliberate flat structure fosters individual accountability and collective responsibility. It is designed to take advantage of the diversity of backgrounds and areas of specialisation to ensure the team can find the investment opportunities others don’t.

Future Quality

The team’s philosophy is based on the belief that investing in a portfolio of Future Quality companies will lead to outperformance over the long term. They define Future Quality as a business that can attain and sustain high return on investment. We believe that ESG considerations and Future Quality investments are not independent of each other and as such the team evaluate the materiality of ESG factors when assessing the Future Quality potential of each stock.

Execution

Effective execution is essential to fully harness Future Quality ideas in portfolios. We combine a differentiated process with a highly collaborative culture to achieve our goal: high conviction portfolios delivering the best outcome for clients. It is this combination of extensive experience, Future Quality style and effective execution that offers a compelling and differentiated outcome for our clients.

About Nikko Asset Management

With USD 243.21 billion* under management, Nikko Asset Management is one of Asia’s largest asset managers, providing high-conviction, active fund management across a range of Equity, Fixed Income and Multi-Asset strategies. In addition, our complementary range of passive strategies covers more than 20 indices and includes some of Asia’s largest exchange-traded funds (ETFs).

*Consolidated assets under management and sub-advisory of Nikko Asset Management and its subsidiaries as of 31 March 2022.

Risks

Emerging markets risk - the risk arising from political and institutional factors which make investments in emerging markets less liquid and subject to potential difficulties in dealing, settlement, accounting and custody.

Currency risk - this exists when the strategy invests in assets denominated in a different currency. A devaluation of the asset's currency relative to the currency of the Sub-Fund will lead to a reduction in the value of the strategy.

Operational risk - due to issues such as natural disasters, technical problems and fraud.

Liquidity risk - investments that could have a lower level of liquidity due to (extreme) market conditions or issuer-specific factors and or large redemptions of shareholders. Liquidity risk is the risk that a position in the portfolio cannot be sold, liquidated or closed at limited cost in an adequately short time frame as required to meet liabilities of the Strategy.