The experience of investing in risk assets over the last six months has been a rather miserable affair for everyone involved—particularly in some corners of the market where we have seen an utter collapse in share prices. We wonder, however, why this should be such a surprise for so many investors.

The evidence would suggest that many investors have become conditioned by the environment that had prevailed for over a decade, with a smooth and clear road to higher prices for equities and indeed most financial assets. The world’s key central banks have had a specific goal of lower yields on financial assets since the great experiment of quantitative easing commenced. We have been in an era that has been less about investing capital and more about deploying capital in the beneficiaries of the great inflation in financial assets.

This era even had its own language: SPAC, FAANG, meme, NFT, crypto, FOMO1 and so on. We live in a world where artificial intelligence is developing rapidly and is able to join the dots within larger data sets much better than humans can, and we will no doubt underestimate the degree of future advances in this area. However, we have just had a good reminder of the power of human thinking, as joining the dots on the wide array of evidence from different sources has been giving us valuable insights for some time.

As a team we are always discussing and debating these observations and the insights they provide as they are very instrumental in both directing our research towards the best new ideas and a correct appraisal of our current investments. The valuation of companies has been a key area of focus, particularly when the last COVID-related round on monetary creation pushed valuation disparities within the market to exceptional levels. Exactly a year ago we wrote “These balloons…will not stay high in the sky…and the only debate will be the speed of descent”. In January we wrote “Make no mistake, there are many aspects of this that have the trappings of a bubble”. This is the human algo (or “Halgo2” for short) in action, and a good reminder to ourselves of the value of staying disciplined and bringing experience to the table.

Whether the current outcome is surprising or not, all investors are now faced with a new and ongoing challenge. Policy makers no longer have our back and inflation rather than the price of risk assets is now their number one priority. The road ahead is not going to be so easy.

Three steps for the new road ahead

It may be easy to become gloomy after the drawdown of the last few months. But we believe that there are plenty of reasons to be optimistic about the prospects for compounding your future capital from today’s levels, if you take into account the following three steps.

1. Recognise that that we have shifted to a different road type, and it is rougher and more variable

As investors in individual companies or markets more broadly, we are constantly being asked to differentiate between volatility that is just short term angst and a signal of change. This is our suggested approach: always be open minded to new information that could undermine a thesis. The thesis, however, is that we are seeing a regime change.

More specifically, inflationary trends are now greater than they were in the past given the scale on monetary creation over the last decade. In the shorter term there will likely be a period of easing pressures as the pending rate-induced recession commences and supply chain pressures ease somewhat. However, on balance structural energy undersupply, labour market constraints and military expenditures will all contribute to sticky inflation at rates likely to be above the 2-3% ideal for central banks. Risk free rates will therefore remain at higher levels.

Secondly, geopolitics will likely remain problematic as the battles for technology hegemony between China and the US and the struggle for military supremacy in Ukraine are likely to be prolonged. The free flow of capital across borders should no longer to be assumed, the cost of borrowing in the world’s reserve currency will likely stay high and we need to be prepared for an increasing shift from actors, such China, moving away from the US dollar as the currency of external trade in the years ahead.

In short, we believe that growth in the broader economy will be less certain and more cyclical, and as a result the cost of capital will not return to the low levels we saw in 2020–2021.

2. Realise that this new road may be best travelled with different vehicles

Those of a certain vintage (myself included) remember the cartoon series “Wacky Races”, courtesy of Hanna-Barbera. With the adoption of a multitude of new and sometimes esoteric ETFs and other thematic vehicles in recent years, it has felt like we have been competing in Wacky Races!

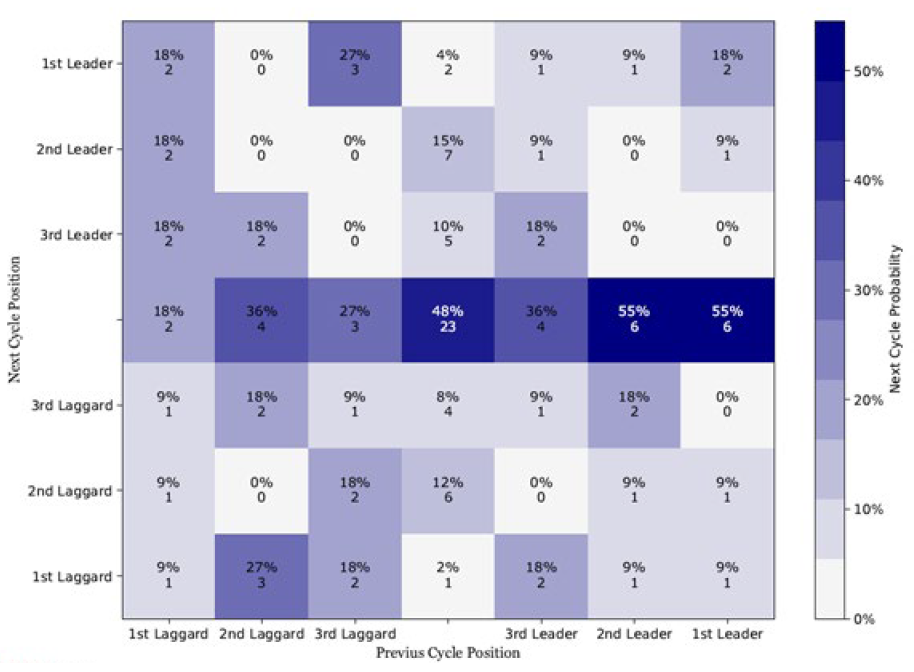

The good, albeit challenging, news for investors is that when there is a regime change, as the significant market correction seems to flag, there is a high probability that there will be new leaders in the race ahead. We have done some work on prior periods of significant market corrections and what the probabilities are, with a clear caveat that the number of reference data points is modest in total. As a reminder, the leaders over the last cycle were information technology, consumer discretionary and energy; assuming they will automatically return as market leaders is a brave call based on this work. Our personal intuition is also that new leadership is likely to emerge this time given the scale of surplus of capital that has just been allocated to the winners.

Leadership in a historical context

Probability of maintaining leadership after market drawdowns >20% (1957-2022)

Source: RENMAC

The above table looks at the probability of a sector in the equity market leading in the next market cycle having led in the previous one. We are all familiar with the outsized returns from the technology sector in recent years but after the recent 20% drawdown in markets, what are the chances that the prior leader can repeat the performance in the next market advance?

This study ranks sectors back to 1957 for the US market. It counts the bull cycle as the point of the price low after a 20% bear market to the subsequent price high before the next 20% drawdown. There are 11 such cycles in the last 65 years. The results may surprise you with the answer to the question “what is the probability of tech leading the market over the next five years or so” answered in the top right of the table. The answer seems to be lower than you might think with just a 27% chance of tech being in the top two sectors for forward returns from here. It is possible therefore but maybe less likely than expected. In fact, the top left shows that there is a somewhat higher probability that the next cycle may be led by those that have lagged the most. This is food for thought as it were and it underlines the need for investors to keep an open mind as to where market leadership will emerge.

2. Improve your probabilities by sticking to a few enduring principles

Invest in price makers versus price takers

It is not just the price for assets that has had favourable tail winds over the last decade, but also profitability. Profit shares as a percentage of GDP have been at record levels in most economies, and this has conditioned investor behaviour, with recency bias leading many to assume that this will remain the norm. Work by empirical research previously highlighted that in the decade prior to 2021, about half of the improvement in profit margins for US manufacturers was down due to lower interest costs and taxes. Whilst lengthening of debt duration may dilute the impact of rising rates, there is now a clear headwind for interest costs and taxes similarly are heading upwards in many economies.

Gross margins are similarly being challenged by rising labour inflation (and availability), a shift to more local and higher cost supply chains, rising raw material input prices and (particularly for those sectors previously benefitting from COVID-related revenue boosts) negative operating leverage as sales decline. On average, times are getting tougher for businesses, and franchise strength is being tested more fully. Where products and business models are unique, dominant or gaining share, the scope for passing on costs to customers and sustaining volume growth is greater.

Ensure capital funding is sustainable

It is now patently clear to all that the cost of debt is going up notably, and as is always the case, the availability of debt could become more irregular. The degree of change in debt costs in US dollars is much greater than in other currencies, and given its reserve currency status it raises the global cost of capital for many businesses. Self-funding growth (high free cash flow) and balance sheets with appropriate and long duration debt, in our view, will be better placed to keep investing through the pending down cycle. Cash-burning, profitless business models likely won’t pass the test.

Focus on justifiable valuations

We have learned, sometimes through bitter experience, that the penalty for investing at inflated prices and a lack of future cashflows is quite onerous. Compounding of capital from levels that can be politely described as “frothy” is really difficult. When the music stops, falls of 80-90% are common for the frothy crowd, and more often than not they stay down as profitability remains a dream rather than reality.

Where we find Future Quality winners

If you are a more seasoned investor none of the above should be particularly surprising. The next key question will likely be: where are you investing your capital within global equities? Companies on a unique journey of improvement that can attain and sustain high returns on invested capital over the next five years or more have always been the best starting point, in our view. These Future Quality ideas are what excite us and have been the foundation of our alpha delivery for over a decade.

For simplicity, though, there are often some common traits for these stock picks and we highlight the following:

Energy transition

Last quarter we highlighted in greater detail the energy transition theme. We very much retain our optimism that an enduring cycle of rising investment is now upon us as societies need to address the challenge of sustaining the still needed fossil fuel production, increasing supply from more trusted regimes, improving energy efficiencies, reducing emissions and further develop alternative energy sources. The latter is key from a climate perspective, but also energy intensive in its own right, creating a circular requirement for the other drivers. In short, the addressable market will grow and surprise investors, and profitability for many suppliers of the “picks and shovels” of the energy transition is on an improving trend. This is an increasing rarity in the current environment.

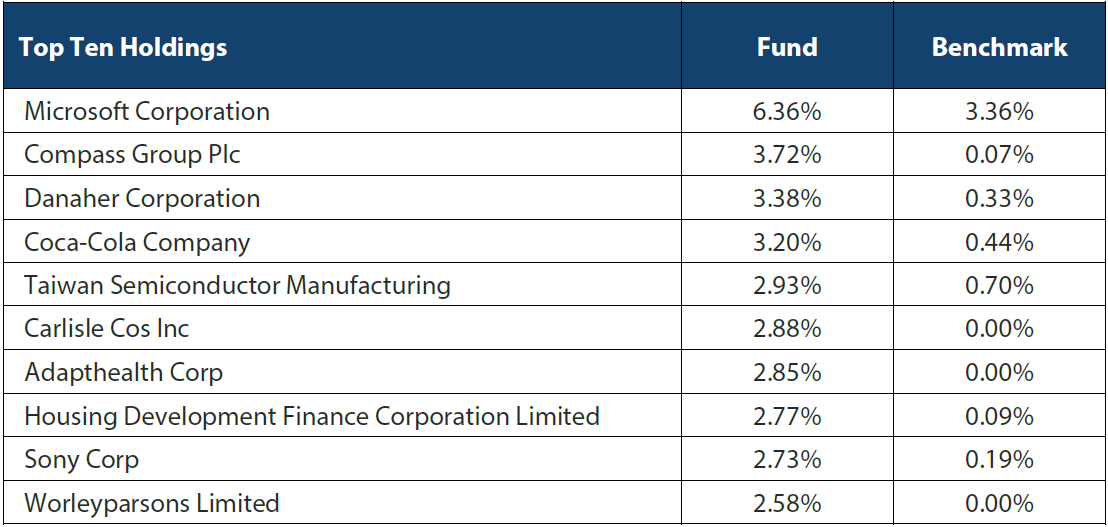

This quarter we have added Worley, a provider of engineering consultancy and design services, and Linde, a leading industrial gas provider, over the last quarter. Both are expected to be price makers in their respective markets.

Enduring growth

Given the backdrop of rising rates and pressures on household consumption, we are increasingly cautious on the growth outlook for many consumer-facing companies. We believe that falling propensity to consume (due to greater spending on mortgage and utility costs) and prior COVID-led pulling forward of demand will be difficult and enduring problems to overcome.

Sustainable growth that is less impacted by consumer cyclicality is therefore preferred. Our long standing overweight in the healthcare sector highlights the fact that we see the demand backdrop for better and more cost effective solutions across ageing societies as being very much enduring in nature. In other sectors we have also added new holdings with similar attributes, such as O’Reilly Automotive and beverage maker Diageo. The need to repair autos given the significant ageing of the fleet in the US will remain strong, and premium spirits will remain an affordable luxury with long life inventory less impacted by the current rise in input costs.

Other recent additions include leading franchises in areas such as travel, where prior consumption has been constrained significantly by COVID and as a result we added Amadeus IT, the world’s largest provider of travel booking systems, to our portfolios.

The final key comment on the area of enduring growth is that we are increasingly concerned about the prospects for digital advertising. Business start-ups and the funding for newer business models have ballooned over 2020–2021, as conducive capital markets have enabled IPOs, SPACs and a flurry of activity in private equity funding. Many of these have been technology-related firms with limited customers and cashflow, and they have been focused on finding new customers. This startup funding in 2021 is estimated at about USD 650 billion in the US (Source: Crunchbase), roughly double the level of prior years.

We assume that about 40% of this will end up in customer acquisition/digital marketing with the majority going to key players such as Meta and Google. This level of spending may now normalise to more sustainable levels as we see new fundings dry up and many existing customers burn through cash reserves. This source of advertising spending will likely see a large drawdown, in turn prompting investors to reappraise their growth assumptions for the leading digital media players. Notable downgrades are not really a key attribute for enduring growth and we have no exposure in this area.

Welcome and thank you

Our team of Future Quality investors was formed over 11 years ago in early 2011 and we have now just passed our eighth anniversary at Nikko AM. Over this time, we have welcomed several new clients and in recent years have proactively invested in the future development of our investment team. This quarter we welcome Finn Stewart to the fold and now the team of portfolio managers/analysts numbers eight in total. We have also further expanded our supporting ESG resource and we welcome Amisha Patel to a new role supporting our UK-based investment teams.

We also want to express a big thank you to the clients who have already joined us on our journey and to everyone within the team and across the firm who has helped developed our franchise to where it is today. Most importantly we always try and make sure that being Future Quality investors is a fun and enjoyable experience—an ingredient of success that is less talked about but more rewarding for all involved.

Top ten holdings

Source Nikko AM as at 31 July 2022.

Reference to individual stocks is for illustration purpose only and does not guarantee their continued inclusion in the strategy’s portfolio, nor constitute a recommendation to buy or sell. Any comparison to a reference index or benchmark may have material inherent limitations and therefore should not be relied upon.

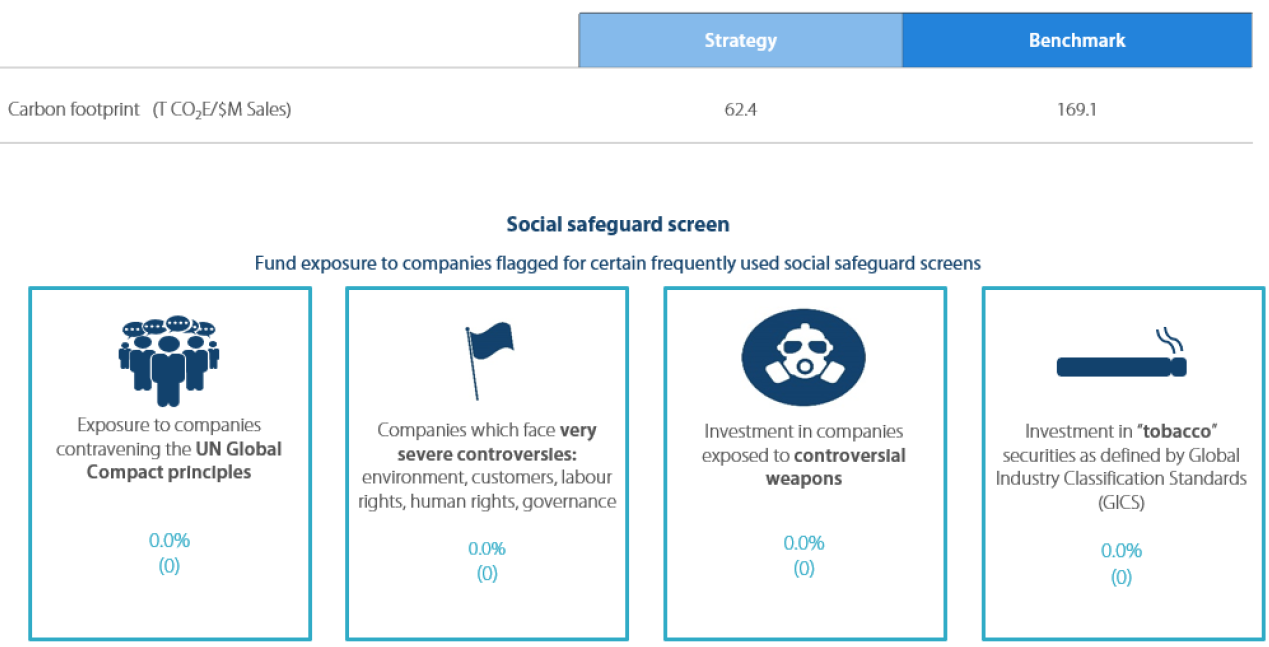

Strong ESG credentials

* Underlying score is the MSCI ESG Quality Score, Carbon Footprint is Weighted Average Carbon Intensity Data supplied as per the MSCI definitions and are subject to change without notice. Fund is a representative account of the Nikko AM Global Equity Strategy. Any comparison to a reference index or benchmark may have material inherent limitations and therefore should not be relied upon. Benchmark is the MSCI ACWI.

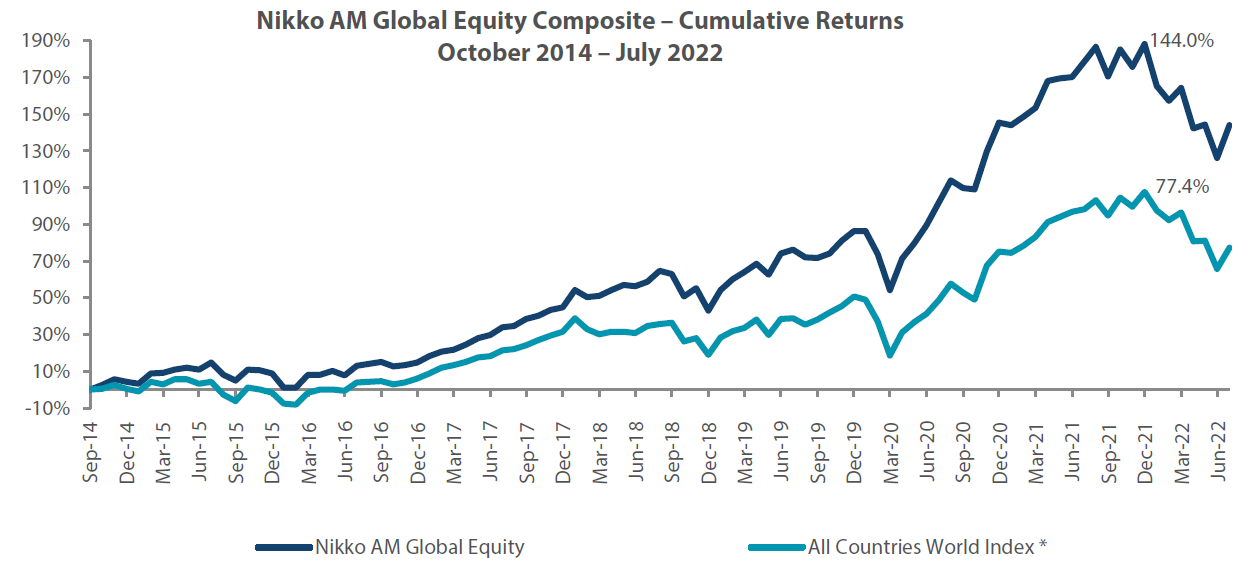

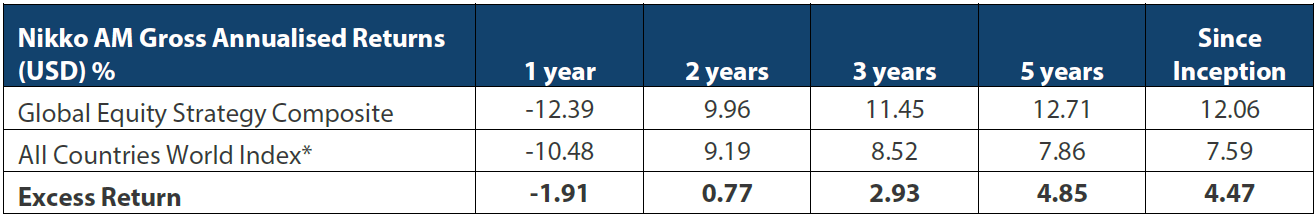

Global Equity Strategy Composite Performance to July 2022

*The benchmark for this composite is MSCI All Countries World Index. The benchmark was the MSCI All Countries World Index ex AU since inception of the composite to 31 March 2016. Inception date for the composite is 01 October 2014. Returns are based on Nikko AM’s (hereafter referred to as the “Firm”) Global Equity Strategy Composite returns. Returns for periods in excess of 1 year are annualised. The Firm claims compliance with the Global Investment Performance Standards (GIPS ®) and has prepared and presented this report in compliance with the GIPS. GIPS® is a registered trademark of CFA Institute. CFA Institute does not endorse or promote this organization, nor does it warrant the accuracy or quality of the content contained herein. Returns are US Dollar based and are calculated gross of advisory and management fees, custodial fees and withholding taxes, but are net of transaction costs and include reinvestment of dividends and interest. Copyright © MSCI Inc. The copyright and intellectual rights to the index displayed above are the sole property of the index provider. Any comparison to reference index or benchmark may have material inherent limitations and therefore should not be relied upon. To obtain a GIPS Composite Report, please contact This email address is being protected from spambots. You need JavaScript enabled to view it.. Data as of 31 July 2022.

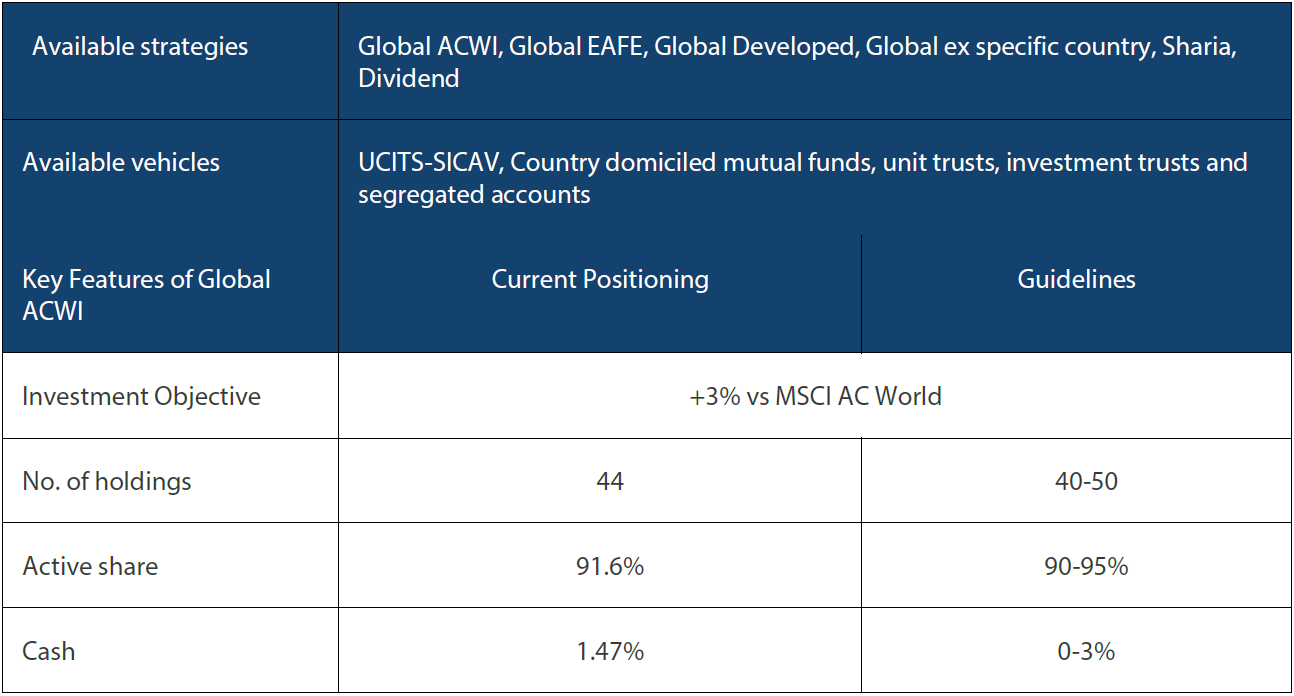

Nikko AM Global Equity: Capability profile and available funds (as of July 2022)

Target return is an expected level of return based on certain assumptions and/or simulations taking into account the strategy’s risk components. There can be no assurance that any stated investment objective, including target return, will be achieved and therefore should not be relied upon. Any comparison to a reference index or benchmark may have material inherent limitations and therefore should not be relied upon. Past performance is not indicative of future performance. This is provided as supplementary information to the performance reports prepared and presented in compliance with the Global Investment Performance Standards (GIPS®). GIPS® is a registered trademark of CFA Institute. Nikko AM Representative Global Equity account. Source: Nikko AM, FactSet.

Nikko AM Global Equity Team

This Edinburgh based team provides solutions for clients seeking global exposure. Their unique approach, a combination of Experience, Future Quality and Execution, means they are continually “joining the dots” across geographies, sectors and companies, to find the opportunities that others simply don’t see.

Experience

Our five portfolio managers have an average of 25 years’ industry experience and have worked together as a Global Equity team for eight years. In 2019, two portfolio analysts, Michael Chen and Ellie Stephenson joined the team followed by Finn Stewart in 2022, they are the first in a new generation of talent on the path to becoming portfolio managers. The team’s deliberate flat structure fosters individual accountability and collective responsibility. It is designed to take advantage of the diversity of backgrounds and areas of specialisation to ensure the team can find the investment opportunities others don’t.

Future Quality

The team’s philosophy is based on the belief that investing in a portfolio of Future Quality companies will lead to outperformance over the long term. They define Future Quality as a business that can generate sustained growth in cash flow and improving returns on investment. They believe the rewards are greatest where these qualities are sustainable and the valuation is attractive. This concept underpins everything the team does.

Execution

Effective execution is essential to fully harness Future Quality ideas in portfolios. We combine a differentiated process with a highly collaborative culture to achieve our goal: high conviction portfolios delivering the best outcome for clients. It is this combination of extensive experience, Future Quality style and effective execution that offers a compelling and differentiated outcome for our clients.

About Nikko Asset Management

With USD 206.1 billion* under management, Nikko Asset Management is one of Asia’s largest asset managers, providing high-conviction, active fund management across a range of Equity, Fixed Income, Multi-Asset and Alternative strategies. In addition, its complementary range of passive strategies covers more than 20 indices and includes some of Asia’s largest exchange-traded funds (ETFs).

*Consolidated assets under management and sub-advisory of Nikko Asset Management and its subsidiaries as of 30 June 2022.

Risks

Emerging markets risk - the risk arising from political and institutional factors which make investments in emerging markets less liquid and subject to potential difficulties in dealing, settlement, accounting and custody.

Currency risk - this exists when the strategy invests in assets denominated in a different currency. A devaluation of the asset's currency relative to the currency of the Sub-Fund will lead to a reduction in the value of the strategy.

Operational risk - due to issues such as natural disasters, technical problems and fraud.

Liquidity risk - investments that could have a lower level of liquidity due to (extreme) market conditions or issuer-specific factors and or large redemptions of shareholders. Liquidity risk is the risk that a position in the portfolio cannot be sold, liquidated or closed at limited cost in an adequately short time frame as required to meet liabilities of the Strategy.