Our Philosophy

In order to pursue excellent performance in domestic bond management, it is critical to evaluate creditworthiness by analysing both quantitative risks, such as debt repayment ability, and qualitative risks that cannot be captured by financial analysis. The environmental, social, and governance (ESG) viewpoint is positioned as an important factor in qualitative risk analysis.

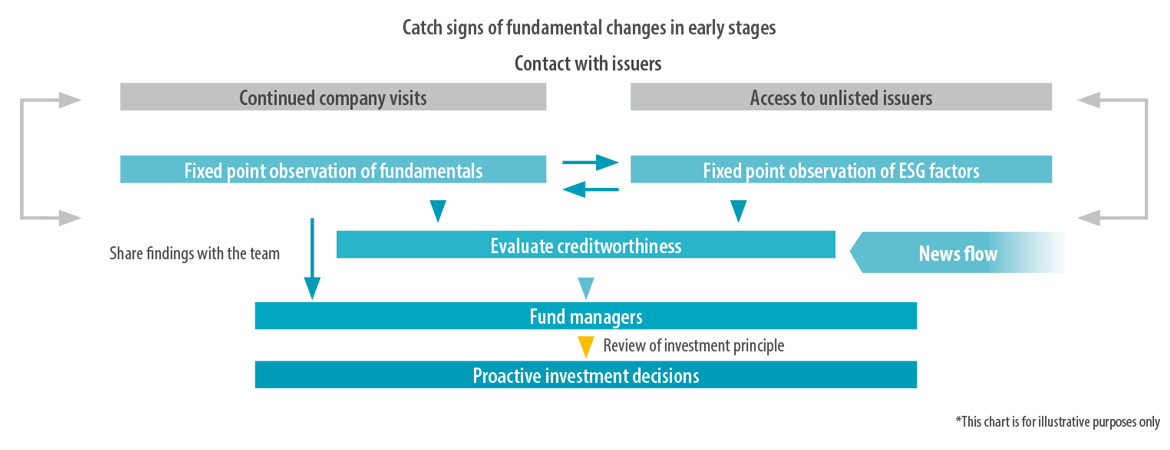

In our team, credit analysts who analyse creditworthiness perform both fundamental analysis and ESG factor analysis of individual issuers. ESG is incorporated into the investment process by comprehensively evaluating both the fundamentals and ESG of the industry/issuer and reflecting it in investment decisions.

ESG Implementation

We have set out eight items (two items related to the environment, and three items each related to society and governance) in analysing ESG factors. Credit analysts are required to evaluate these ESG factors alongside fundamentals in the issuer report. In addition, we share ESG views within our team at monthly meetings attended by fund managers and credit analysts. We believe that frequent conversations on ESG support a process that allows us to promptly reflect a change in circumstances that negatively affects creditworthiness, including ESG events.

A framework that catches momentum change