Our Philosophy

To generate new growth, companies today must have a strong approach to ESG. By investing in the stocks of such companies, we believe that excess returns can be achieved over the medium to long term. The Japan Equity team aims to generate alpha by selecting companies with superior ESG practices through a stock selection process that combines both negative and positive screening, and an optimisation process that incorporates thorough risk management.

ESG Implementation

When we conduct a historical comparison between leading ESG indices and the TOPIX (Tokyo Stock Price Index), it is apparent that ESG indices do not always outperform the market. This implies that investing in companies with superior ESG ratings on its own is insufficient for outperformance. Instead, a well-conceived approach is necessary when implementing ESG considerations. As with any investment, appropriate stock selection and portfolio management are crucial to improve performance and control risk within an ESG strategy.

The Japan Equity team believes that a superior ESG investment process should:

- pursue alpha through a combination of financial and non-financial information, including ESG factors

- focus on ESG factors that lead to future earnings and strengthen competitiveness

- involve consistent engagement with corporate management teams

CSV evaluations of individual stocks: Positive screening

All active Japan equity investment strategies incorporate Creating Shared Value (CSV) evaluations, which take ESG factors into consideration. It is a comprehensive score that was developed by applying the CSV theory proposed by Professor Michael Porter of Harvard University. The score assesses how companies balance their engagement of ESG issues with the pursuit of profitability and competitiveness, in order to create value for both society and shareholders. Our analyst research has incorporated CSV evaluations since 2013.

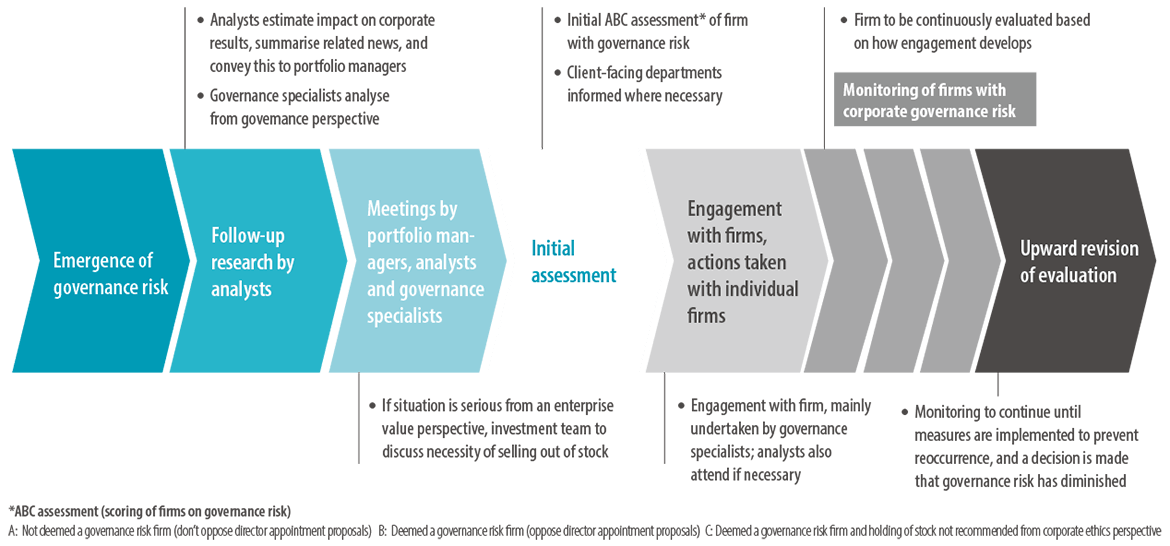

Approach to firms with governance risk: Negative screening

Firms that have been involved in criminal conduct, fraud, and/or accounting fraud, or that have caused environmental or social problems, are classified as having governance risk. The Japan Equity team excludes firms with perceptible corporate governance risk from its investment universe, while also seeking to promote better governance by engaging with the firms it invests in.

Operational flow for handling firms with governance risk