Our Philosophy

We see the Asian region as being comprised of diverse growth markets, where fundamental drivers can lead to substantial and rapid change. As such, our investment process is focused on applying rigorous fundamental research to identify companies that are capable of sustainable high returns and/or positive fundamental change. We believe that investing in companies with these characteristics will deliver superior performance over the long term.

Within this process, ESG is a key pillar of our assessment of the sustainable returns and fundamental change characteristics of the companies we research. As a result, we focus on ESG issues that are material to shareholder returns, for the foreseeable future.

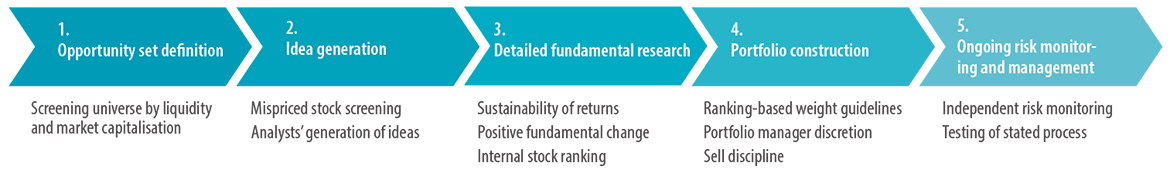

Robust, tried-and-tested investment process

ESG Implementation

As ESG research is integrated into our fundamental research process, it is undertaken by our team of analysts and portfolio managers, and it is considered together with input from external ESG research and data providers.

Our ESG evaluation process starts with identifying the key issues that will be material for shareholder returns for each company we cover. These issues could be risks to returns, which include potentially disruptive events, and risks that lead to a gradual erosion of shareholder returns. The issues also include ESG opportunities, which could result in a material enhancement of shareholder returns.

Once the issues are identified, we evaluate the ESG performance of the companies with regard to each issue. We assess how firms are mitigating risks and accessing ESG-related opportunities. This evaluation then feeds into our overall rating of sustainable returns and fundamental change for the company. We also apply an ESG flag to companies we deem to be not investible, whether due to unacceptable risks or poor ESG performance with no evidence of improvement.

Finally, we identify key issues for continuing engagement with the companies we cover. These include outstanding ESG issues that companies are in the process of resolving or opportunities that are being developed. If appropriate, we will suggest options that best enhance shareholder returns.