SEPTEMBER 2023

The Nikko AM ARK Disruptive Innovation Strategy seeks to capture long-term capital growth by taking advantage of changing trends caused by technology-enabled innovations that cut across economic sectors, industries and geographic regions.

ARK Investment Management LLC (ARK), a strategic partner of the Nikko AM Group, is the investment advisor for the strategy. Based in St. Petersburg, Florida, ARK is an investment manager focused solely on disruptive innovation that should change the way the world works.

ARK’s investment philosophy

ARK believes that innovation is key to growth. Disruptive innovation is the introduction of a technology-enabled product or service that changes an industry landscape typically by offering simplicity and accessibility, while driving down costs. Despite its potential, the magnitude of disruptive innovation and the investment opportunities it creates are often unrecognized or misunderstood by traditional investors. ARK believes it can outperform broad-based benchmarks over the course of a full market cycle, with low correlations of relative returns to traditional growth and value strategies.

Investment strategy

The Nikko AM ARK Disruptive Innovation Strategy aims for long-term capital growth by actively managing a portfolio of high-conviction stocks that are relevant to the theme of disruptive innovation. The portfolio represents ARK’s highest-conviction investment ideas in the areas of Autonomous Technology & Robotics, Genomics Innovation, Next-Generation Internet, and Fintech Innovation. The strategy seeks to invest in the leaders, enablers, and beneficiaries of disruptive technologies.

The strategy is benchmark agnostic. It can invest in companies across multiple sectors and geographies. Portfolios can include issuers across all capitalizations with low overlap with traditional broad market indices.

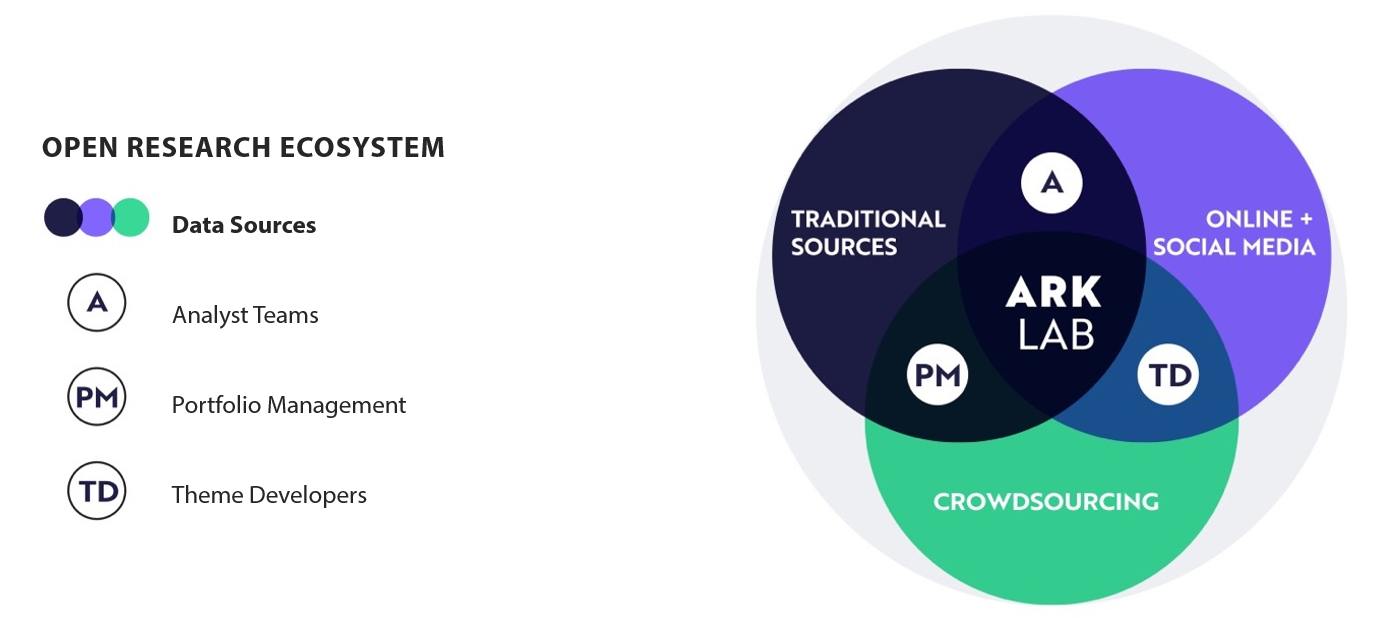

The strategy is driven by ARK’s unique research process, which incorporates an open research architecture (“Open Research Ecosystem”) designed to gain a deeper understanding of quickly changing themes.

Strategy characteristics

ARK's investment team

The Nikko AM ARK Disruptive Innovation Strategy is advised by ARK’s chief investment officer and portfolio manager Catherine Wood, who has over 40 years of industry experience.

Cathie is the CEO and founder of ARK, which was registered with the SEC as an investment adviser in January 2014. Prior to ARK, she spent twelve years at AllianceBernstein as CIO of Global Thematic Strategies, a role in which she managed over USD 5 billion. Cathie joined Alliance from Tupelo Capital Management, a hedge fund she co-founded which managed USD 800 million in global thematic strategies. Prior to this, she worked for 18 years with Jennison Associates as chief economist, equity research analyst, portfolio manager and director. She started her career at The Capital Group as an assistant economist. Cathie received her Bachelor of Science, summa cum laude, in Finance and Economics from the University of Southern California in 1981.

ARK’s Chief Futurist, Brett Winton, who has worked alongside Cathie for almost 15 years, is focused on driving ARK’s long-term forecasts across convergent technologies, economies, and asset classes, thereby helping ARK dimension the impact of disruptive innovation as it transforms public equities, private equities, cryptoassets, fixed income, and the global economy. Prior to ARK, Brett served as a vice president and senior analyst on the Research on Strategic Change team at AllianceBernstein. He earned his Bachelor of Science in Mechanical Engineering at the Massachusetts Institute of Technology (MIT).

ARK's investment process

ARK recognizes that many traditional research analysts, by focusing narrowly on individual sectors, create inefficiencies in the financial markets both in understanding the market potential of disruptive innovations and in sizing investment opportunities appropriately. ARK’s cohesive team, specifically its Chief Futurist, Directors of Research and Investment Analysis, Associate Portfolio Managers, Research Analysts, Research Associates and its Portfolio Manager (“ARK Team”), seek to identify what they believe to be the best companies within their respective themes (and the elements within those themes) to power ARK’s investment decisions. ARK’s distinctive and dynamic investment process is rooted in fundamental analysis and distinguished by ARK’s ability to access and harness the vast amount of information available through social media and traditional research sources to support ARK’s investment decisions.

ARK has a rigorous investment process, which includes “top-down” and “bottom-up” investment analysis and a proprietary scoring system. ARK’s investment process initially examines from the top-down how the world is changing and where it is headed. By anticipating and quantifying multi-year value-chain transformations, typically caused by technologically enabled disruptive innovation, ARK believes it can capitalize on these opportunities. To understand quickly changing innovation themes, ARK employs an open research strategy to gather information and refine its internal research process. Inputs include ideas, thoughts and public information from theme developers who we believe are thought leaders in their fields, social media interactions, and crowd-sourced insights as people respond to ARK’s public research.

Using this information in an iterative fashion, ARK’s Team works to “size” and “re-size” the opportunities. As a result of extensive and iterative research steps, ARK anticipates and quantifies multi-year value-chain transformations and market opportunities. ARK models cost-curves and calculates elasticity of demand to identify entry points for technology-enabled disruption. Through this process, specific companies percolate to the top as those we believe are best positioned to benefit from the identified investment premise, at which point ARK begins its bottom-up process.

ARK scores potential investments based on six key metrics, inputting the values into a proprietary scoring system to quantify the companies in the context of the opportunity. ARK builds models that incorporate the company’s unit volume growth, cost declines, market adoption and penetration, share count growth, and future multiples. The CIO has final accountability for the selection of investments and approval for all investment decisions.

ARK's Open Research Ecosystem

ARK’s ideation process is driven by ARKs “Open Research Ecosystem” which is designed to identify disruptive innovation early, allowing for an organized exchange of insights between the investment team, research team and external sources. ARK believes that a combination of top-down and bottom-up research allows ARK to size the investment opportunity of disruptive innovation, and then detect and rank companies best positioned to benefit. External inputs include Theme Developers. Theme Developers are people who we consider to be thought leaders in the professional and academic world, who offer meaningful insights, experience, and knowledge about one of ARK’s research themes. Theme Developers are not employees of ARK, do not receive compensation from ARK and are contractually obligated to, among other things: not exchange material non-public information; not share confidential information about ARK and/or its clients; and disclose all conflicts of interest.. Additional inputs include social media interactions and crowd-sourced insights as people respond to ARK’s public research. By applying technological concepts and external inputs to traditional approaches, ARK seeks to create a more transparent, creative, and interdisciplinary investment process.

ARK’s Open Research Ecosystem is designed for scale and sustainability. This system requires the research team to generate work that can be easily understood, dissected, and passed along. This allows analysts to frictionlessly build atop each other’s work, facilitates the easy on-boarding of new analyst talent, and allows for ready solicitation and incorporation of outside perspective and expertise. ARK’s research is published at https://ark-invest.com/research-center .

Top-down research to define the investment universe

ARK’s investment process initially examines from the top-down how the world is changing and where it is headed. To understand quickly changing innovation themes, ARK gathers information from the Open Research Ecosystem. Using this information in an iterative fashion, ARK’s investment team works to “size” and “re-size” the opportunities, and then anticipates and quantifies multi-year value-chain transformations and market opportunities. Through this process, specific companies percolate to the top and are best positioned to benefit from the identified investment premise, which leads to the bottom-up process.

Bottom-up analysis to refine the investment opportunity

ARK’s bottom-up analysis begins with the aforementioned, distilled group of potential investments. ARK scores potential investments based on the following six key metrics:

- People, Management and Culture

- Execution

- Moat/Barriers to Entry

- Product and Service Leadership

- Valuation

- Thesis Risk

The valuation metric requires building out a revenue model for each company in the portfolio over the next five years. These models incorporate the company’s unit volume growth, cost declines, market adoption and penetration, share count growth, and future multiples, arriving ultimately at a per share price five years from the current date that should be roughly double the current price.

Finally, as CIO and portfolio manager, Catherine Wood has final accountability for the selection of investments and approval for all investment decisions.

Why Disruptive Innovation?

ARK believes that disruptive innovation is key to long-term growth of company revenues and profits and, therefore, focuses solely on investing in disruptive innovation. We define ‘‘disruptive innovation’’ as the introduction of a technologically enabled new product or service that should change an industry landscape by creating simplicity and accessibility, while driving down costs. Despite its potential, we think the full magnitude of disruptive innovation and the investment opportunities it creates are often unrecognized or misunderstood by traditional investors. ARK performs research across sectors, industries, and markets to gain a deeper understanding of the convergence and market potential of disruptive innovations.

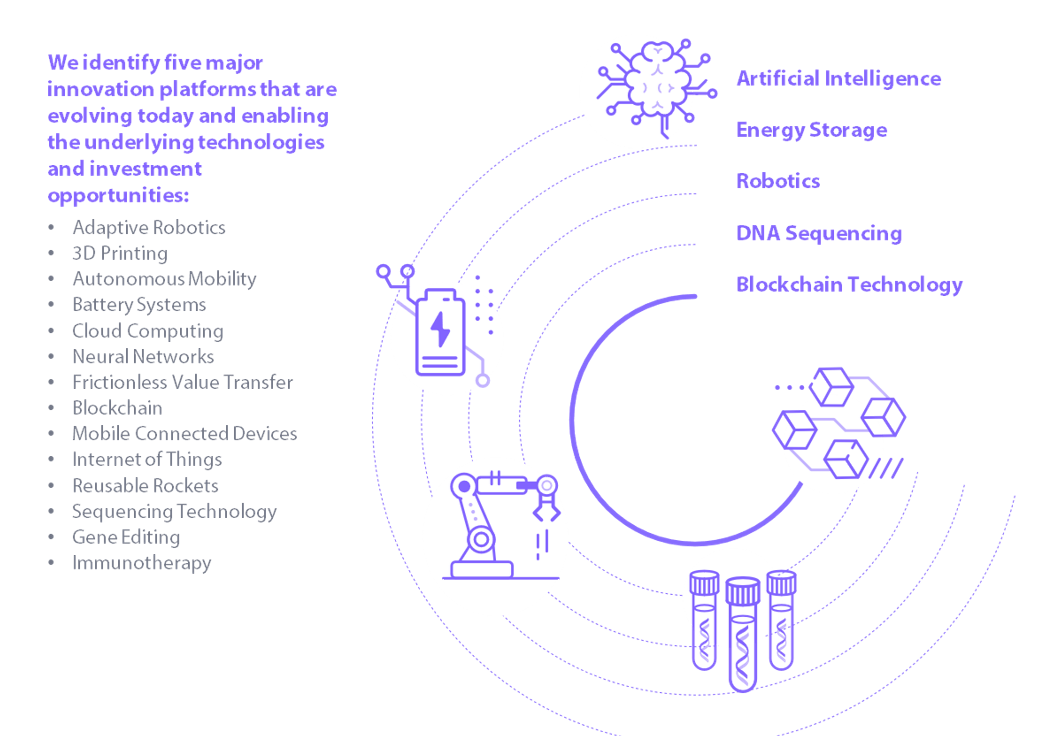

Five major innovation platforms

ARK has identified five major disruptive innovation platforms: Artificial Intelligence, Energy Storage, Robotics, DNA Sequencing and Blockchain Technology. These platforms consist of transformative technologies that ARK believes should deliver dramatic cost declines, impact many industries and geographies, and serve as a platform for more innovation. ARK maintains high conviction in the meaningful growth of these platforms due to our top-down modeling, as well as conviction in individual companies that that ARK believes will be the leaders and/or beneficiaries within their respective technology spaces.

Public Blockchains

Upon large-scale adoption, we believe all money and contracts will migrate onto Public Blockchains that enable and verify digital scarcity and proof of ownership. The financial ecosystem is likely to reconfigure to accommodate the rise of Cryptocurrencies and Smart Contracts. These technologies increase transparency, reduce the influence of capital and regulatory controls, and collapse contract execution costs. In such a world Digital Wallets will become increasingly necessary as more assets become money-like, and corporations and consumers adapt to the new financial infrastructure. Corporate structures themselves may be called into question.

Artificial Intelligence

Computational systems and software that evolve with data can solve intractable problems, automate knowledge work, and accelerate technology’s integration into every economic sector. The adoption of Neural Networks should prove more momentous than the introduction of the internet and potentially create 10s of trillion dollars of value. At scale these systems will require unprecedented computational resources, and AI-specific compute hardware should dominate the Next Generation Cloud datacenters that train and operate AI models. The potential for end-users is clear: a constellation of AI-driven Intelligent Devices that pervade people’s lives, changing the way that they spend, work, and play. The adoption of artificial intelligence should transform every sector, impact every business, and catalyze every innovation platform.

Energy Storage

Declining costs of Advanced Battery Technology should cause an explosion in form factors, enabling Autonomous Mobility systems that collapse the cost of getting people and things from place to place. Electric drivetrain cost declines should unlock micro-mobility and aerial systems, including flying taxis, enabling business models that transform the landscape of cities. Autonomy should reduce the cost of taxi, delivery, and surveillance by an order of magnitude, enabling frictionless transport that we believe will increase the velocity of e-commerce and make individual car ownership the exception rather than the rule. These innovations combined with large-scale stationary batteries should cause a transformation in energy, substituting electricity for liquid fuel and pushing generation infrastructure towards the edge of the network.

Robotics

Catalyzed by artificial intelligence Adaptive Robots can operate alongside humans and navigate legacy infrastructure changing the way products are made and sold. 3D Printing should contribute to the digitization of manufacturing, increasing not only the performance and precision of end-use parts but also the resilience of supply chains. Meanwhile the world’s fastest robots, Reusable Rockets, should continue to reduce the cost of launching satellite constellations and enable uninterruptible connectivity. A nascent innovation platform, robotics could collapse the cost of distance with hypersonic travel, the cost of manufacturing complexity with 3D printers, and the cost of production with AI-guided robots.

Multiomic Sequencing

The cost to gather, sequence and understand digital biological data is falling precipitously. Multiomic Technologies provide research scientists, therapeutic organizations and health platforms with unprecedented access to DNA, RNA, protein and digital health data. Cancer care should transform with pan-cancer blood tests. Multiomic data should feed into novel Precision Therapies using emerging gene editing techniques that target and cure rare diseases and chronic conditions. Multiomics should unlock entirely new Programmable Biology capabilities, including the design and synthesis of novel biological constructs with applications across industries, particularly agriculture and food production.

Portfolio and risk management

Thematic portfolios built around disruptive innovation face certain risks. For instance, a primary risk to ARK’s investment strategy is that a disruptive technology or disruptor company could become itself disrupted or not fulfill its promise.

To mitigate this risk, ARK continuously monitors the investment thesis of each of its portfolio companies using the Portfolio Tracker. The Portfolio Tracker amalgamates bottom-up scores, both qualitative and quantitative, for all stocks in the portfolio. Within each portfolio ARK tracks a stock’s “Thematic Relevance” to evaluate its position. Changes in analysts' scores trigger discussion with the portfolio manager during regular stock meetings. Examples of risks that may trigger a downgrade by analysts include the following:

People, Management, and Culture

- Departure of key personnel

- Inefficient talent acquisition

- Threat of Legal Action

- Poor Governance

Execution

- Insufficient/ declining R&D spending

- Incorrect target operating model

- Poor sales and marketing execution

Moat/ Barriers to Entry

- Rise of new disruptive technologies

- Increasing competitive pressure

- Trade barriers and subsidies

Product & Service Leadership

- Loss of market share

- Lack of vision for future innovation

- Monitoring incorrect KPIs

Valuation

- The average rate of return for a stock drops below 15% average over five years

Thesis Risk

- Regulatory risk

- Geopolitical risk

- Technology adoption risk

- Environmental and social risk

Analysts are responsible for monitoring the portfolio companies they cover on an ongoing basis. However, the primary responsibility for managing the portfolio risk lies with the portfolio manager.

Risks Information

Catalogue and Mail Order House Company Risk - Catalogue and mail order house companies may be exposed to significant inventory risks that may adversely affect operating results due to, among other factors: seasonality, new product launches, rapid changes in product cycles and pricing, defective merchandise, changes in consumer demand and consumer spending patterns, or changes in consumer tastes with respect to products. Demand for products can change significantly between the time inventory or components are ordered and the date of sale.

Disruptive Innovation Risk - Companies that the Investment Manager believes are capitalising on disruptive innovation and developing technologies to displace older technologies or create new markets may not in fact do so. Companies that initially develop a novel technology may not be able to capitalise on the technology. Companies that develop disruptive technologies may face political or legal attacks from competitors, industry groups or local and national governments. These companies may also be exposed to risks applicable to sectors other than the disruptive innovation theme for which they are chosen, and the securities issued by these companies may underperform the securities of other companies that are primarily focused on a particular theme. The Sub-Fund may invest in a company that does not currently derive any revenue from disruptive innovations or technologies, and there is no assurance that a company will derive any revenue from disruptive innovations or technologies in the future.

Cryptocurrency Risk - Notably bitcoin, often referred to as ‘‘virtual currency’’ or ‘‘digital currency,’’ operates as a decentralised, peer-to-peer financial exchange and value storage that is used like money. The Fund may have exposure to bitcoin, a cryptocurrency, indirectly through an investment in the Bitcoin Investment Trust (‘‘GBTC’’), a privately offered, open-end investment vehicle. Cryptocurrency operates without central authority or banks and is not back by any government. Even indirectly, cryptocurrencies (i.e., bitcoin) may experience very high volatility and related investment vehicles like GBTC may be affected by such volatility. As a result of holding cryptocurrency, the Fund may also trade at a significant premium to NAV. Cryptocurrency is also not legal tender. Federal, state or foreign governments may restrict the use and exchange of cryptocurrency, and regulation in the U.S. is still developing. Cryptocurrency exchanges may stop operating or permanently shut down due to fraud, technical glitches, hackers or malware.

Financial Technology Risk - FinTech companies may not be able to capitalise on their disruptive technologies if they face political and/or legal attacks from competitors, industry groups or local and national governments. Laws generally vary by country, creating some challenges to achieving scale. A FinTech company may not currently derive any revenue, and there is no assurance that a FinTech company will derive any revenue from innovative technologies in the future.

Future Expected Genomic Business Risk - The Investment Manager may invest some of the Sub-Fund’s assets in Genomics Revolution Companies that do not currently derive a substantial portion of their current revenues from genomic-focused businesses and there is no assurance that any company will do so in the future, which may adversely affect the ability of the Sub-Fund to achieve its investment objective.

Biotechnology Company Risk - A biotechnology company’s valuation can often be based largely on the potential or actual performance of a limited number of products and can accordingly be greatly affected if one of its products proves, among other things, unsafe, ineffective or unprofitable.

Pharmaceutical Company Risk - Companies in the pharmaceutical industry can be significantly affected by, among other things, government approval of products and services, government regulation and reimbursement rates, product liability claims, patent expirations and protection and intense competition.

Information Technology Sector Risk - The information technology sector includes companies engaged in internet software and services, technology hardware and storage peripherals, electronic equipment instruments and components, and semiconductors and semiconductor equipment. Information technology companies face intense competition, both domestically and internationally, which may have an adverse effect on profit margins. Information technology companies may have limited product lines, markets, financial resources or personnel. The products of information technology companies may face rapid product obsolescence due to technological developments and frequent new product introduction, unpredictable changes in growth rates and competition for the services of qualified personnel. Failure to introduce new products, develop and maintain a loyal customer base, or achieve general market acceptance for their products could have a material adverse effect on a company’s business. Companies in the information technology sector are heavily dependent on intellectual property and the loss of patent, copyright and trademark protections may adversely affect the profitability of these companies.

Web x.0 Companies Risk - Internet information provider companies provide Internet navigation services and reference guide information and publish, provide or present proprietary advertising and/or third party content. Such companies often derive a large portion of their revenues from advertising, and a reduction in spending by or loss of advertisers could seriously harm their business. This business is rapidly evolving and intensely competitive, and is subject to changing technologies, shifting user needs, and frequent introductions of new products and services. The research and development of new, technologically advanced products is a complex and uncertain process requiring high levels of innovation and investment, as well as the accurate anticipation of technology, market trends and consumer needs. The number of people who access the Internet is increasing dramatically and a failure to attract and retain a substantial number of such users to a company’s products and services or to develop products and technologies that are more compatible with alternative devices, could adversely affect operating results. Concerns regarding a company’s products, services or processes that may compromise the privacy of users or other privacy related matters, even if unfounded, could damage a company’s reputation and adversely affect operating results.

Derivative risk - the Strategy may use derivatives as described in the Prospectus - Objectives and Investment Policy. Use of derivatives results in higher chances of loss due to the use of leverage, or borrowing. Derivatives allow investors to earn large returns from small movements in the underlying asset's price. However, investors could lose large amounts if the price of the underlying assets moves against them significantly.

Sustainability Risk

The risk arising from any environmental, social or governance events or conditions that, were they to occur, could cause material negative impact on the value of the investment. Specific sustainability risk can vary for each product and asset class, and include but are not limited to: Transition Risk, Physical Risk, Social Risk and Governance Risk.

If you intend to invest in the UCITS Fund, please refer to the Fund Prospectus in order to identify whether the Sub-Fund will manage sustainability factors within the meaning of the SFD Regulation (EU) 2019/2088: an article 6 (limited to analysing sustainability risk as part of its risk management process), an article 8 (which also promotes certain environmental and social characteristics) or article 9 (which has sustainable investment as its primary objective).