We visited Vietnam in February and found that business and economic prospects have turned around completely for the better from a year ago. Interest rates have normalised, and mortgage terms are the most favourable that we have ever seen in Vietnam. We discovered that a full resolution to the corporate bond debacle is now possible and that consumer spending has stabilised. We also found that government policies are supportive of foreign direct investment (FDI) growth and that capital market reforms are forthcoming.

A 180-degree turnaround in just 12 months

What a difference a year makes. When we visited Vietnam a year ago, the mood was sombre. Interbank rates had spiked as liquidity dried up following the first rate hikes by the US Federal Reserve. Mortgage rates rose to as high as 15%, throttling the residential market and straining the finances of borrowers. The corporate bond market was in turmoil, with borrowers unable to refinance maturing bonds due to tightened issuance standards and a lack of bank lending support. Consumers were pessimistic, with the tech downturn having impacted jobs and wages.

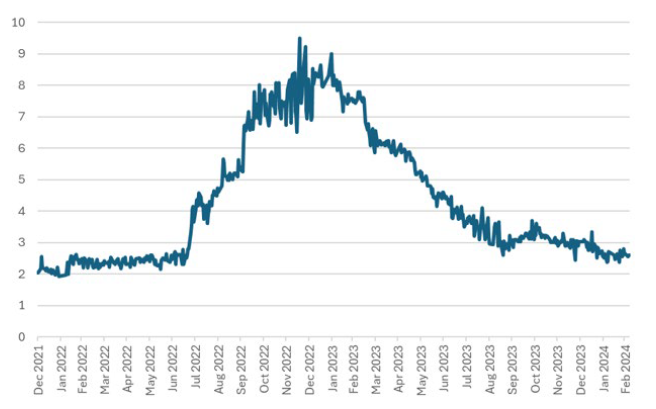

When we revisited the country this February, the situation could not be more different. Though they remain a touch above the lows seen in 2022, interbank rates have fallen (Chart 1). More surprising, mortgage rates have dropped to their lowest levels ever, with banks offering rates as low as 6–7%, fixed over the initial years of a mortgage. Mortgage terms are also at their most favourable, with tenures up to 35 years being offered. Importantly, borrowers are now able to effectively refinance their mortgages for the first time, by taking on a better offer. All of this is, of course, hugely beneficial for the residential market, especially in the mid- and low-end segments.

Chart 1: Vietnam three-month interbank rate

Source: Bloomberg, March 2024

Full resolution to the bond debacle possible

We also see a path to a full resolution for the corporate bond debacle. In 2023, Vietnamese dong 59 trillion worth of bonds maturing during the year had seen their maturities extended by an average of 20 months, which bought their issuers time to resolve the problems that have prevented them from securing refinancing. In particular, for issuers in the real estate sector, we now expect the government to be more amenable to resolving the various legal issues surrounding their property projects. This allows the projects to again be sold to buyers and to secure refinancing from either issuing new bonds or accessing bank financing. In the meantime, new bond issuances have picked up again under tighter new rules, which is positive for investor protection.

Consumer sentiment has stabilised, with more improvement to come

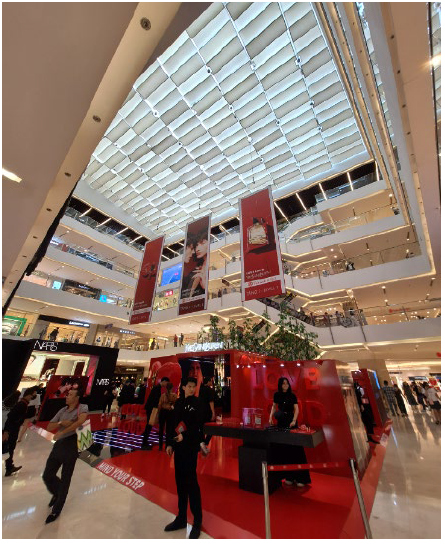

Consumers are visibly more positive in 2024 compared to a year ago. A major mall in downtown Ho Chi Minh City was teeming with shoppers when we visited on a Sunday afternoon, with a luxury apparel brand conspicuously holding a noisy promotional event in the atrium space. From our meetings, we found that consumer companies generally expected the worst to have passed for sales in key categories including mobile phones and consumer electronics. Despite their continued caution, we hold a more optimistic view, particularly in light of the boost from lower mortgage rates and a potentially more vibrant residential market.

Figure 1: Busy atrium in a downtown mall in Ho Chi Minh City

Source: Asian Equity Team, February 2024

Outlook for industrial-related sectors also positive

We also returned with a positive view of Vietnam’s industrial, energy and utilities sectors. Vietnam remains a leading alternative to China as a manufacturing base, particularly for mobile phones and consumer electronics. As such, FDI disbursement has remained robust, reaching a new high of US dollar 23.2 billion in 2023. Growing manufacturing activity is driving demand for industrial park space as well as electrical power. With its modest reserve margins, we expect the government to prioritise the development of new gas fields, as well as transmission lines linking the energy-rich southern region to the northern parts of the country where the electronics industries are located.

Efforts to be upgraded from frontier to emerging market now closer to fruition

While not central to our investment thesis, Vietnam’s efforts towards capital market reforms could finally be coming to fruition. The impetus for change is the country’s self-imposed deadline for inclusion into a major emerging market (EM) index by 2025. The index most likely to do so is FTSE, as Vietnam is already on its watchlist of frontier markets (FM) which could potentially be upgraded to EM status. One criteria for the upgrade is the implementation of a new trading system for the Ho Chi Minh City Stock Exchange, which will now take place in March after a protracted delay.

Perhaps in anticipation of a potential upgrade to an EM market, investors at the conference we attended appear, for the first time, to feature more EM investors (many of whom appear new to Vietnam) than FM specialists. To that end, further reforms which are in the pipeline are expected to help broaden out interest in Vietnamese stocks. They include the loosening of pre-funding rules for buying stocks and, further down the line, the implementation of a depository system which will allow foreigners to trade in stocks where the foreign ownership limit is full.

Market still attractive despite gains; time for new ideas, resharpened focus

Vietnamese stocks have recovered well since we were last in the country. Looking at the year to-date performance alone, the Ho Chi Minh Stock Index has been one of the best performing in Asia in US dollar terms. Despite the gains, valuations remain attractive, at a price-to-earnings ratio of 11.7x, against 14–17x, the range seen in the years immediately preceding the COVID-19 pandemic. We returned from latest visit more positive on well-funded and well-managed residential developers, industrial park developers, selected consumer companies, and selected utilities and logistics players. We will be looking to resharpen our focus on these areas, including new holdings which we intend to initiate coverage on.