In August 2024, Japanese stocks underwent a correction, due to fears over the Bank of Japan (BOJ)’s hawkish stance and concerns about a US recession. However, we believe this was both an overreaction and a value investing opportunity for long-term focused investors.

We attribute the simultaneous yen appreciation and drop in Japanese equities largely to the rapid unwinding of the “Japan Carry Trade”, where investors borrow in Japanese yen to re-deploy into other higher yielding assets. Furthermore, we believe it’s unlikely that the new Japanese government and the BOJ, while aiming for a “positive cycle of wage increases and price rises”, will adopt a policy of continuous interest rate hikes that could negatively impact corporate earnings and create further uncertainty for wage increases. Instead, we expect a positive economic cycle due to improved return on equity from corporate governance reforms, as well as the normalisation of monetary policy and escape from deflation.

In the past, when extreme market pessimism occurred, such as after Brexit in 2016 and the COVID pandemic in 2020, there were significant corrections in undervalued stocks. While we anticipate it will take time for volatile market trends to stabilise, we believe now is a prime opportunity for bargain hunting in the Japanese market, where structural changes are already well underway. In the medium to long term, we see the potential for an upward shift in valuations.

Why a value investing approach for Japanese equities

The mature nature of the Japanese economy makes its stock market highly cyclical, allowing seasoned investors to take advantage of repeated patterns. In this type of market, a consistent application of contrarian value-oriented investment is an effective way to generate excess returns.

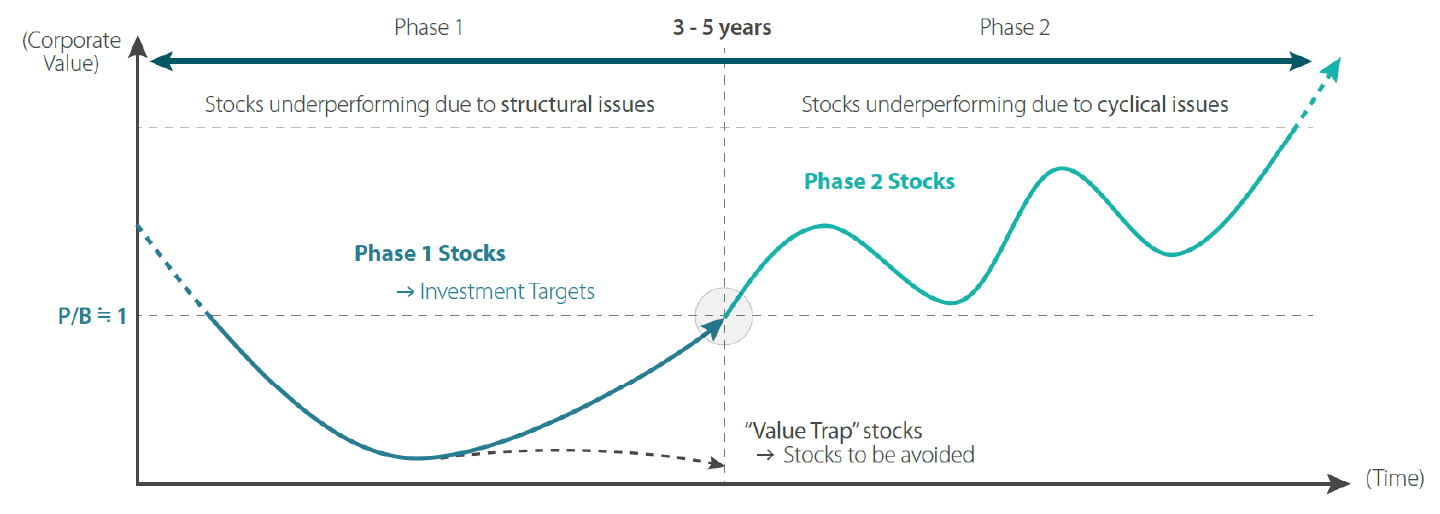

When a stock price displays poor performance, our Japan value team evaluates whether this is due to a structural or cyclical issue. Outperformance can be achieved by making long-term investments in stocks that are underperforming due to structural issues but possess a turnaround catalyst.

We define these as “Phase 1 stocks”, where a catalyst may be either a structural change due to the company’s own efforts (supply-side catalyst) or a structural or environmental change in the market (demand-side catalyst). By contrast, “Phase 2 stocks” would be those that are underperforming due to cyclical issues (Chart 1). Active management looks to understand the type of cycle the company is experiencing and the position of the company within that cycle.

Chart 1: Phase 1 and Phase 2 stocks

For illustrative purposes only. Source: Nikko AM.

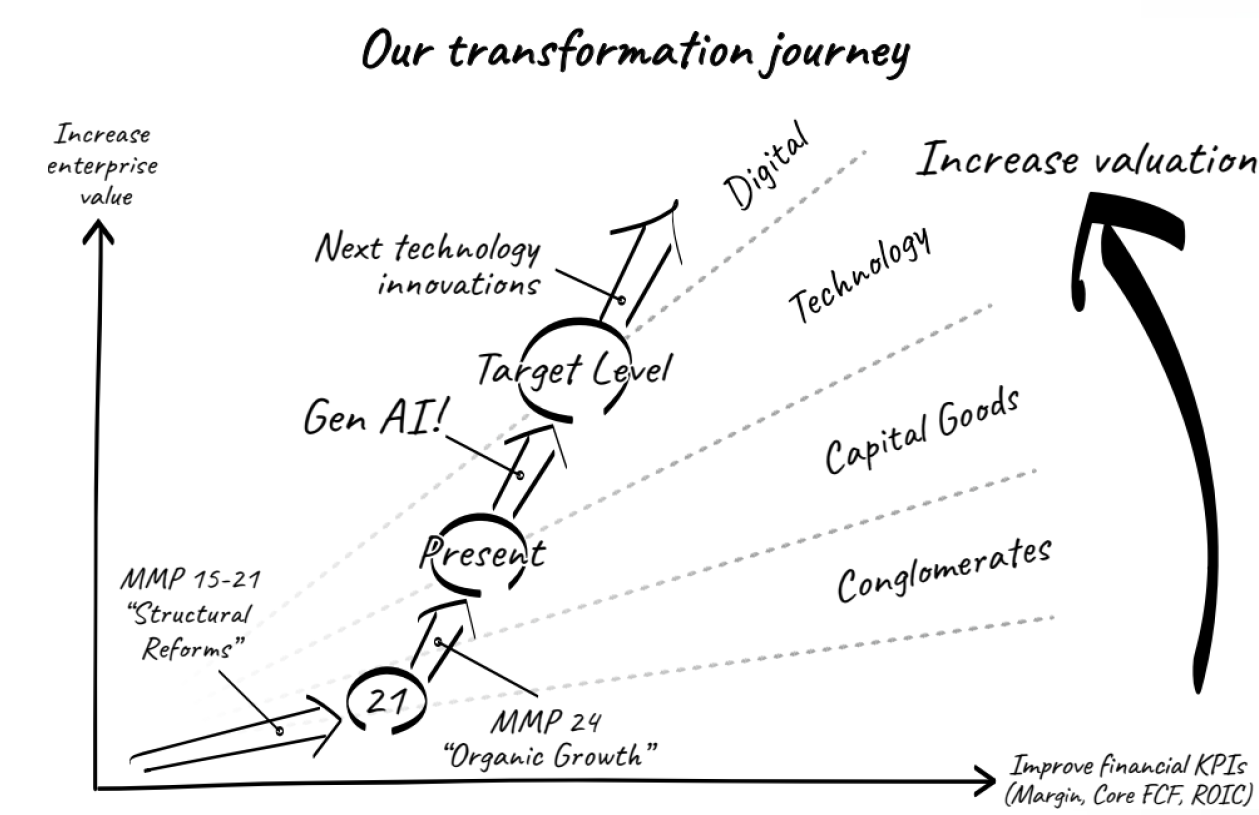

Stock example: Hitachi

We first invested in Hitachi in 2013 when it was a Phase 1 stock with a share price of around JPY 570. Currently, it is at JPY 3,970, nearly a sevenfold increase. With over a century of history, Hitachi’s revenues had historically been very cyclical, involving industrial products such as electric generators, consumer electronics, trains, computers, and nuclear reactors. Following the Global Financial Crisis, the company reviewed its business portfolio and focused on strengthening its service business and accelerating global expansion, with its social innovation business as the new core. It then reorganized itself into three divisions: Digital Systems and Services, Green Energy and Mobility, and Connective Industries.

Hitachi’s capable and determined management team continues to implement structural reforms from within. These changes have significantly altered the company's revenue structure, shifting it away from being heavily influenced by cyclical factors. Since streamlining the business into these three divisions, the recovery in cashflow return on investment (CFROI) has been remarkable. Recent sales of underperforming Medtech to Fujifilm and other non-core segments illustrates the streamlining taking place. Interestingly, Hitachi has also acquired well. It bought GlobalLogic, a US-based IT implementation company which applies agile development techniques for clients undergoing digital transformation. This has bolstered Hitachi's IT offerings, and it is focused on continuing to expand its digital solutions business centred on an Internet of Things (IoT) platform called Lumada.

Hitachi is also well positioned to accelerate the clean energy transition with another key acquisition in ABB's grid business comprising transformers, high-voltage direct current (HVDC) lines, and switch gear, at a time when the market is set to expand with growing electrification trends. We’ve participated in Hitachi’s positive transition from a Phase 1 stock to a Phase 2 stock and continue to believe it still has considerable future potential going forward. By clearly considering capital costs, solidifying a base of stable revenue streams, and defining areas for growth, Hitachi has positioned itself for sustained growth.

Chart 2: Hitachi’s transformation journey

Source: Hitachi Integrated Report 2024

Summary

We see the Japanese economy steadily progressing in overcoming deflation and improving corporate governance, undergoing significant structural changes. While it takes time for the impact of management strategies aimed at long-term profitability to become apparent in performance, we are committed to capturing these changes. We will invest in companies that are positively transforming to enhance their corporate value from a long-term perspective.

To learn more about unlocking hidden value in Japan, download the Nikko AM investment guide here.

Nikko AM team in Europe

Email: This email address is being protected from spambots. You need JavaScript enabled to view it.

Any reference to a particular security is purely for illustrative purpose only and does not constitute a recommendation security. Nor should it be relied upon as financial advice in any way.