Did the BOJ take a dovish turn at its September policy meeting?

Following a two-day policy meeting that ended on 20 September, the Bank of Japan (BOJ) decided to maintain the overnight call rate target at 0.25%. The central bank’s decision to stand pat, which followed a surprise rate hike in July, was widely expected. However, comments by BOJ Governor Kazuo Ueda at the post-meeting press conference caught the market’s attention. Ueda said that as upside inflation risks due to a weaker yen had decreased, the BOJ had the time to assess the situation before making a decision on monetary policy. The market interpreted this statement as dovish, especially as it contrasted with the apparently hawkish stance Ueda had taken at the BOJ’s prior meeting.

However, it would be premature to conclude that Ueda took a dovish turn in September. The BOJ’s rate hike in July may have caught the market off guard, but the move appeared justifiable with the steady rise in Japanese wages factored in. The central bank should not be in a hurry to hike rates again, and as Ueda signalled, waiting to assess the various elements of the economy before tightening policy is a reasonable approach.

The market's perception of Ueda's comments in September as dovish may have been influenced by the possibility that the governor is keeping in mind currency market swings. Ueda likely wants to signal that the continued rise in wages is supportive of rate hikes over the long term. However, the governor could be experiencing frustration as the currency market, judging from dollar-yen moves, seems to have questioned the BOJ’s ability to continue raising rates. Back in July the BOJ was able to drive home the point that it was firmly on a tightening path by conducting a surprise rate hike. However, the market volatility that ensued was not something the BOJ had desired; in our view, Ueda’s tame comments in September could be seen as an attempt by the governor to offset some of the volatility triggered in July.

Although Ueda’s comments in September may have slightly dented such views, expectations still linger in the market that the BOJ will implement one more rate hike in 2024. However, our view is that the BOJ is unlikely to tighten its policy again until early 2025. Whether the BOJ hikes in 2024 or holds off until early 2025, one consequence of the post-hike market turbulence in July is that the BOJ will likely be more effective in telegraphing its move in an attempt to avoid creating volatility. This could limit the impact of the policy move on currencies, with the yen perhaps not strengthening as much as it did in July. Therefore, the focus for the market will be on how currencies, specifically the yen, react to the BOJ's next rate hike, rather than on how Japanese bond yields respond.

Steady rise in wages paves way for consumption and ultimately higher stocks

Recently released data showed that Japan’s real wages rose 0.4% year-on-year (YoY) in July, beating forecasts of a decline. Additionally, average wages excluding bonuses and non-scheduled payments increased 2.7% YoY, marking the biggest rise in approximately three decades. These numbers offer further indications that wages were steadily moving above inflation. The rise in average wages is particularly noteworthy as it encourages consumers to increase their spending. As wages typically follow inflation with a lag, the current trend of steadily rising wages coupled with subsiding inflation could drive a recovery in consumption, benefiting Japan's domestic sectors.

The ongoing labour shortage is a key factor driving higher wages, and its duration will determine the sustainability of this trend. The current labour shortage is expected to persist for another year or two thanks to a soft landing scenario for the US economy. If the US economy avoids a hard landing, that will ensure a certain amount of demand for Japanese exports, leading to strong labour demand among domestic manufacturers. Additionally, the recovery in domestic consumption should create labour shortages by opening up a new source of worker demand.

Higher wages and robust consumption could help the economy gradually overcome any negative effects from a stronger yen and higher domestic interest rates. This is because the resulting labour shortage will encourage a variety of domestic demand-oriented sectors to invest capital to make up for the shortage of workers, providing a lift to the domestic equity market. Japan’s political situation is difficult to read from a market perspective after Shigeru Ishiba replaced Fumio Kishida as prime minister following his victory in the ruling party’s leadership vote late in September. It is difficult to gauge Ishiba’s policy direction as he immediately called for a snap election after taking office. Therefore, an assessment of Ishiba’s policy may have to be put on hold until the snap election is over.

September market summary: Japanese equities slip amid political uncertainty

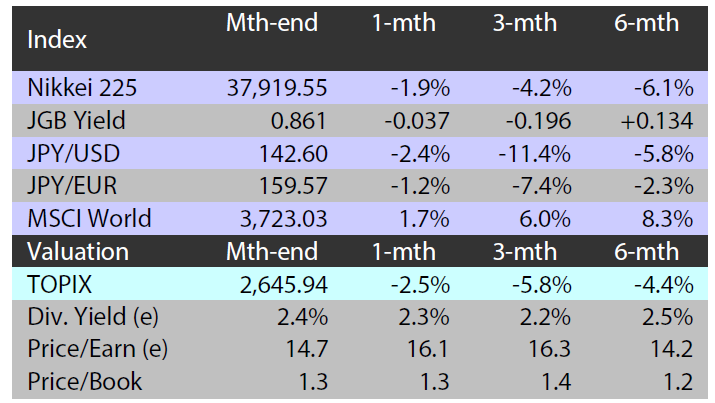

The Japanese equity market ended September lower with the TOPIX (w/dividends) down 1.53% month-on-month and the Nikkei 225 (w/dividends) falling 1.24%. Stocks were weighed down in the first half of the month after US ISM manufacturing index figures fell short of expectations which raised concerns regarding a potential slowdown in the US economy and further appreciation of the yen versus the dollar. In the latter half of the month, anticipation grew that the US economy would be supported as the US Federal Reserve starting to slash rates, while in Japan expectations receded for additional rate hikes at an early stage in light of BOJ Governor Ueda’s remarks at the press conference following the latest Monetary Policy Meeting, both factors which boosted Japanese equities. However, the market fell again at the end of the month due to concerns of rising political uncertainty based on the results of the election of a new leader for Japan’s ruling party.

Of the 33 Tokyo Stock Exchange sectors, 14 sectors rose, with Textiles & Apparel, Air Transportation, and Warehousing & Harbor Transportation Services posting the strongest gains. In contrast, 19 sectors declined, including Pharmaceuticals, Mining, and Securities & Commodity Futures.

Exhibit 1: Major indices

Source: Bloomberg, 30 September 2024 |

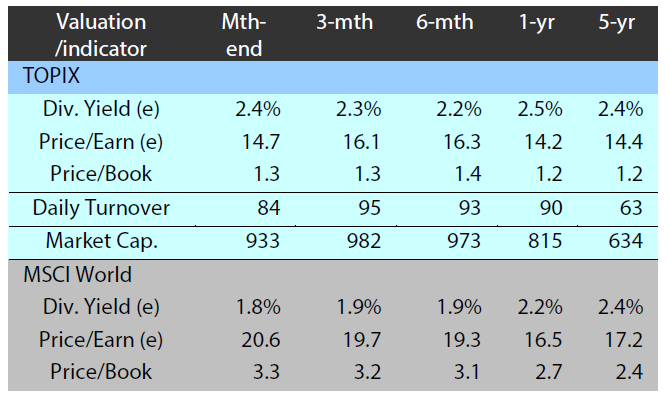

Exhibit 2: Valuation and indicators

Source: Bloomberg, 30 September 2024 |