Summary

- US Treasury (UST) yields declined across the board in June as several key economic indicators fell short of expectations. At the end of the month, the benchmark 2-year and 10-year UST yields settled at 4.76% and 4.40%, respectively, 12 basis points (bps) and 10 bps lower compared to end-May. Within Asia, headline inflation prints for May accelerated in China, Malaysia, Thailand, Singapore and the Philippines. On the other hand, Indonesia, India and South Korea experienced a slight moderation.

- We favour South Korean, Indian and Philippine government bonds and have adopted a neutral stance on Indonesian bonds.

- Asian credits gained 1.23% in June, despite credit spreads widening about 9 bps as UST yields eased. Asian investment-grade (IG) credit slightly underperformed its Asian high-yield (HY) counterpart, returning 1.21% with spreads widening about 10 bps. Asian HY credit returned 1.32% with spreads widening by 12 bps.

- The increase in new issue supply amidst falling all-in yields prompted modest profit-taking which drove spreads wider over the month. We view such technical correction as healthy and believe it creates better entry opportunities. Demand for Asia credit remains robust from regional institutional investors looking to lock in attractive yields. However, the emergence of certain negative risk factors may result in modestly higher volatility in Asia credit spreads in the second half of the year.

Asian rates and FX

Market review

UST yields ease further in June

In June, UST yields declined across the board as several key economic indicators fell short of expectations. A significant portion of the Treasury bond rally was spurred by signs of moderating inflation. Both the consumer price index (CPI) and producer price index for May showed softer-than-expected increases, prompting market reassessment of future US interest rate cuts. The rally gained further momentum from an increase in continuing claims for jobless benefits. Notably, the decline in yields persisted despite the June Federal Open Market Committee dot plot surprising the market with projections of only one rate cut this year, down from the three estimated in March.

Meanwhile, the European Central Bank delivered its widely anticipated 25 bps policy rate cut and offered “data-dependent” forward guidance. Towards the end of June, however, UST yields partially rebounded from their earlier decline following statements from US Federal Reserve officials emphasising a patient and data-dependent approach. At end-June, the benchmark 2-year and 10-year UST yields settled at 4.76% and 4.40% respectively, 11.9 bps and 10.2 bps lower compared to end-May. Separately, the US dollar strengthened against most major currencies in June, driven by mounting political uncertainties in France and escalating concerns over economic growth in China.

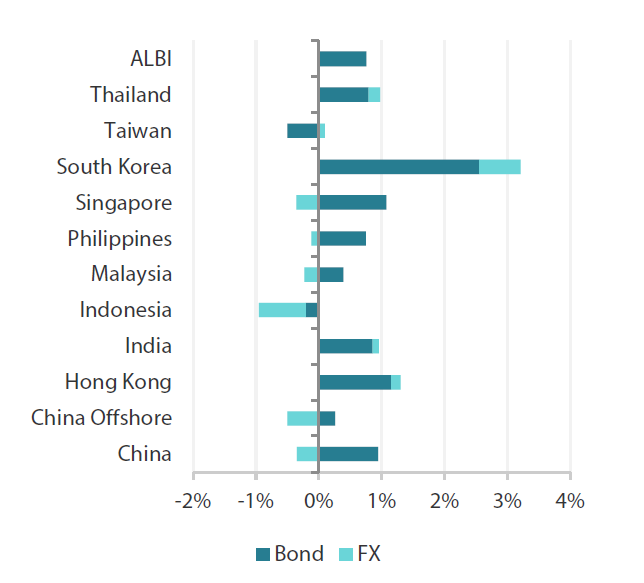

Chart 1: Markit iBoxx Asian Local Bond Index (ALBI)

|

For the month ending 30 June 2024

|

For the year ending 30 June 2024  |

Source: Markit iBoxx Asian Local Currency Bond Indices, Bloomberg, 30 June 2024

Central banks leave their policy rates unchanged

Monetary authorities in Thailand, Indonesia, India and the Philippines left interest rates unchanged in June. The Bank of Thailand (BOT)’s Monetary Policy Committee voted 6 to 1 to keep its one-day repurchase rate steady at 2.50%, with one member voting for a 25-bps reduction. Alongside this decision, the central bank maintained its economic growth forecasts for 2024 and 2025 at 2.6% and 3.0%, respectively, and projected headline inflation at 0.6% for 2024 and 1.3% for 2025.

Bank Indonesia (BI) held its benchmark seven-day reverse repo rate at 6.25%, aligning with its pre-emptive, forward-looking approach to control inflation and strengthen the rupiah, according to BI Governor Perry Warjiyo. Despite global uncertainties, Indonesia’s growth remains robust, supported by central bank and government policies, with 2024 growth projected at 4.7% to 5.5%. BI also expects both headline and core inflation to stay within the target ranges in 2024.

In the Philippines, the Bangko Sentral ng Pilipinas (BSP) kept its key policy rate unchanged. According to the central bank’s monetary board, inflation risks have shifted to the downside, primarily due to the effect of reduced import tariffs on rice. The central bank revised its risk-adjusted inflation forecast down to 3.1% for 2024, from 3.8%, and to 3.1% for 2025, down from 3.7%. BSP Governor Eli Remolona indicated that the anticipated decrease in price pressures could allow the central bank to lower rates by 25 bps in the third quarter and another 25 bps in the fourth quarter.

Elsewhere, the Reserve Bank of India (RBI) held its policy repo rate steady at 6.50%. The Monetary Policy Committee also decided to continue focusing on the withdrawal of accommodation. Notably, two external members voted to reduce the policy rate by 25 bps and change the policy stance to neutral.

Headline inflation prints mostly accelerate in May

Overall inflation prints for May accelerated in China, Malaysia, Thailand, Singapore and the Philippines. On the other hand, Indonesia, India and South Korea experienced a slight moderation. The Philippines’ headline CPI accelerated to 3.9% year-on-year (YoY) from 3.8% in April, driven by faster increases in utility and transport costs. However, core inflation, which excludes volatile food and energy items, eased to 3.1% in May from 3.2% in April.

In Singapore, core inflation remained steady at 3.1% YoY for three consecutive months through May, with an increase in services inflation offset by lower inflation for electricity and gas, retail and other goods. Headline inflation rose to 3.1% YoY in May from 2.7% in April due to higher prices for vehicles and petrol. Policymakers expect core inflation to gradually moderate for the remainder of the year, with a more noticeable decline anticipated in the fourth quarter.

Thailand’s headline inflation accelerated to 1.54% YoY in May from 0.19% in April, returning to the BOT’s target range of 1–3% for the first time in 13 months. The acceleration was driven by low base effects and the removal of the diesel price subsidy. Excluding energy and raw food prices, core inflation remained largely steady at 0.39% YoY.

Conversely, Indonesia's annual inflation rate eased more than expected to 2.84% YoY in May from 3.0% in April, staying within the central bank's target range of 1.5% to 3.5%. Meanwhile, the annual core inflation rate slightly increased to 1.93% in May, up from 1.82% the previous month.

PBOC considers trading CGBs in the secondary market

People’s Bank of China (PBOC) Governor Pan Gongsheng announced in June that the central bank might resume trading Chinese government bonds (CGBs) in the secondary market as a new method to manage liquidity. He also revealed that the PBOC is considering refining its official policy rates to allow a single short-term rate in guiding banks, noting that the seven-day reverse repo rate has essentially assumed this function and de-emphasised the 1-year Medium-term Lending Facility rate as a policy rate.

Malaysia cuts diesel subsidies

As part of a widely-publicised fiscal subsidy rationalisation plan, Malaysia reduced diesel subsidies on 10 June, a measure expected to save the government approximately Malaysian ringgit (MYR) 4 billion annually. As a result, the price of diesel increased by around 56%, bringing it more in line with market prices. The government also intends to implement similar changes for gasoline subsidies in the future.

Indian election surprise

In India, the results of the parliamentary elections in June surprised markets, with Prime Minister Narendra Modi’s party failing to secure an outright majority, causing initial weakness in Indian bonds and equities. However, sentiment reversed when the new cabinet’s composition indicated policy continuity, with senior ministers from the previous Modi government retaining their positions.

Market outlook

Positive on South Korea, India and Philippine bonds

We favour South Korean, Indian and Philippine government bonds and have adopted a neutral stance on Indonesian bonds.

Recent dovish remarks from the Philippine central bank governor indicate a potential shift towards rate cuts, with lower-than-expected inflation prints in April and May providing the monetary authority with ample room to lower rates.

Price pressures in India have been consistently easing, and the growing divide within the RBI’s Monetary Policy Committee suggests that a pivot towards easing may happen soon. Indian government bonds were included in JP Morgan’s GBI-EM Index starting 28 June, with an initial 1% weight that will increase by 1% each month, reaching a maximum of 10% by March 2025. This gradual increase is expected to further support the strength of Indian bond prices.

In South Korea, the central bank released its mid-year assessment of monetary policy, presenting a more dovish inflation outlook, citing weak domestic demand and easing supply-side pressures. We take this to suggest an impending policy rate normalisation. Additionally, the steady disinflation in core CPI provides the central bank more leeway to ease rates earlier than regional peers.

In contrast, sentiment towards Indonesian government bonds will likely be weighed down by persistent fiscal slippage concerns until a new finance minister is appointed.

Asian credits

Market review

Asian credits register gains anew in June

Asian credits returned +1.23% in June despite credit spreads widening about 9 bps due to UST yields easing. Asian IG credits slightly underperformed Asian HY credits, gaining 1.21% despite spreads widening by about 10 bps. Meanwhile, Asian HY returned +1.32%, even as spreads widened 12 bps.

Following significant spread compression since the start of the year, Asian credit spreads widened in June amid falling UST yields and a pick-up in new issue supply. Investors took profits on some Chinese property names after a substantial rally in the sector in recent months. Official home price indices in China, which continued to decline in May despite significant government stimulus measures, also affected sentiment. Other economic activity data in China continued to show mixed signals across various segments of the economy.

Elsewhere, global ratings agency Fitch kept the Philippines’ credit rating at “BBB” with a “stable” outlook, citing the country’s robust medium-term growth potential, stable debt levels and strong macroeconomic policies. By the end of June, spreads for all major country segments widened, with South Korean credits outperforming and Macau credits underperforming.

Primary market activity picks up in June

The month saw a notable pick-up in new supply, with issuers concentrated in China and South Korea. The IG space saw 22 new issues amounting to USD 13.4 billion, including the USD 2.35 billion three-tranche sovereign issue from Indonesia’s Perusahaan Penerbit SBSN, the USD 2.0 billion three-tranche issue from LG Energy Solution and the USD 1.0 billion sovereign issue from the Republic of Korea. Meanwhile, the HY space saw five new issues amounting to USD 2.15 billion.

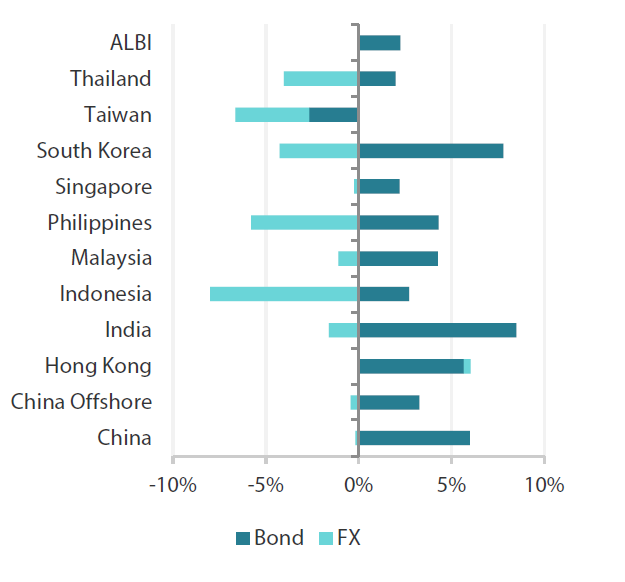

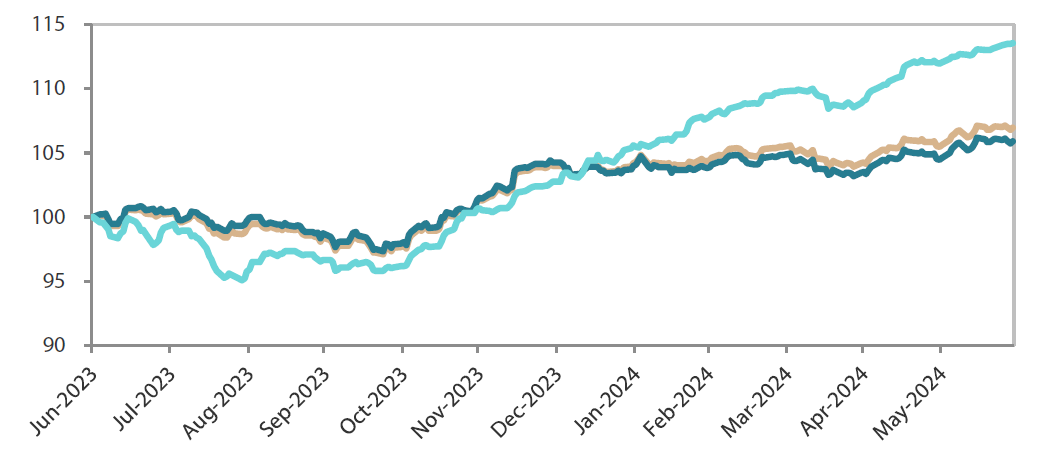

Chart 2: JP Morgan Asia Credit Index (JACI)

Index rebased to 100 at 30 June 2023

Note: Returns in USD. Past performance is not necessarily indicative of future performance.

Source: Bloomberg, 30 June 2024.

Market outlook

Healthy technical correction creates better entry opportunities amidst supportive fundamentals

The fundamentals backdrop for Asian credit remains supportive. In China, overall policy stance remains incrementally accommodative. However, given the still-fragile recovery in the real economy, particularly in the property market, more easing measures are likely to be implemented. Meanwhile, macroeconomic and corporate credit fundamentals across Asia ex-China are expected to stay resilient, with a recovery in exports growth potentially offsetting softer domestic conditions. While non-financial corporates may experience a slight weakening in both leverage and interest coverage ratios stemming from lower earnings growth and higher funding costs, we believe there is adequate ratings buffer for most, especially the IG corporates. Asian banking systems remain robust, with strong capitalisation and strong pre-provision profitability providing buffers against moderately higher credit costs ahead.

The pick-up in new issue supply amidst falling all-in yields prompted modest profit-taking which drove spreads wider in June. We see such technical correction as healthy and believe that it creates better entry opportunities. Demand for Asia credit remains robust from regional institutional investors looking to lock in attractive all-in yields, even as fund flows into emerging market hard currency funds remain subdued. Looking ahead, however, some risks such as local political uncertainties, trade tensions, concerns over the US presidential election outcome in November and the growth-inflation dynamic in developed economies may result in modestly higher volatility in Asia credit spreads in the second half of the year, compared to the serenity of the first half.