ESG in the Asia of today

As of February 2023, 1,965 companies and organisations in the Asia-Pacific region had signed up to the Task Force on Climate-related Financial Disclosure (TCFD) requirements, accounting for almost half of the TCFD’s 4,000-plus supporters.1 In addition, more than 600 companies within the region have signed up to the Science Based Targets Initiative (SBTi), putting themselves on a clearly defined and measurable path towards reducing carbon emissions in line with the Paris Agreement goals.2

At the same time, the rapid advance of ESG as an investment trend has led to a profusion of interpretations of what ESG actually means. This makes it a potential source of confusion and contradiction for investors, especially in a world of diverse and shifting causes and issues, ranging from climate change to human rights.

Moreover, the complex and fast-changing economies and societies that make up Asia – the same characteristics that make Asia such a rich source of investment opportunity – continue to challenge investors hoping to apply comprehensive ESG analysis across Asian asset classes.

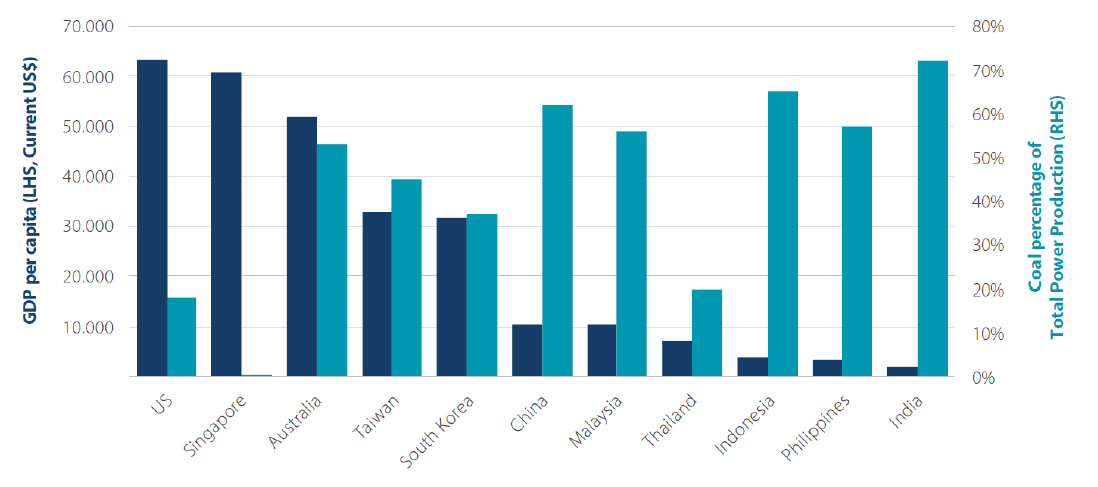

One of the reasons for this complexity comes from the diverse stages of economic development being experienced by Asian countries. Indeed, across the Asia-Pacific region, gross domestic product (GDP) per capita can range from as low as USD 1,500 to as high as USD 60,000 (Figure 1).

Such disparity of incomes and resources leads to vastly different economic and social priorities, as well as the broad spectrum of opportunities and risks among ESG factors. In addition, Asian companies often have ownership structures that differ from those in developed economies. In Asia, majority ownership, either by the state or founding families, is predominant.

Assessing governance must then be conducted less according to textbook norms, but by applying a more granular understanding of the objectives, character, and motivations of the majority owners, whether state or private.

1https://www.fsb-tcfd.org/supporters/

2Companies taking action - Science Based Targets

Figure 1: GDP per capita in Asia, coal as a percentage of total power production

Source: World Bank, Local Central Banks, HSBC, Nikko AM.

ESG integration leads to more opportunities and better risk control

From a portfolio management perspective, investing in companies capable of demonstrating strong or improving ESG credentials has become essential for generating higher sustainable returns. At Nikko AM, we believe ESG analysis and engagement is just as important as fundamental bottom-up research, and should be backed by dedicated ESG resources and independent data providers.

Due to our underlying philosophy of integrating ESG criteria within our stock analysis, we strongly believe that having a robust and improving ESG framework is fundamental for companies that want to achieve and sustain high returns.

We believe that the most important aspect of the ESG criteria is the impact it has on a company’s sustainable returns. And as bottom-up investors focused on company fundamentals, we scrutinise factors deemed most material to returns – in terms of both risks and opportunities.

As investors, we are looking for underappreciated strong levels of ESG risk management or underappreciated (or overlooked) positive ESG change. These factors will typically result in the best impact on shareholder returns.

Companies known for their industry-leading ESG management typically already command premiums. We also assess materiality through a uniquely Asian lens, by being cognisant of differences in ownership, culture, and stages of development when compared with developed markets.

The challenges of gathering ESG-related data

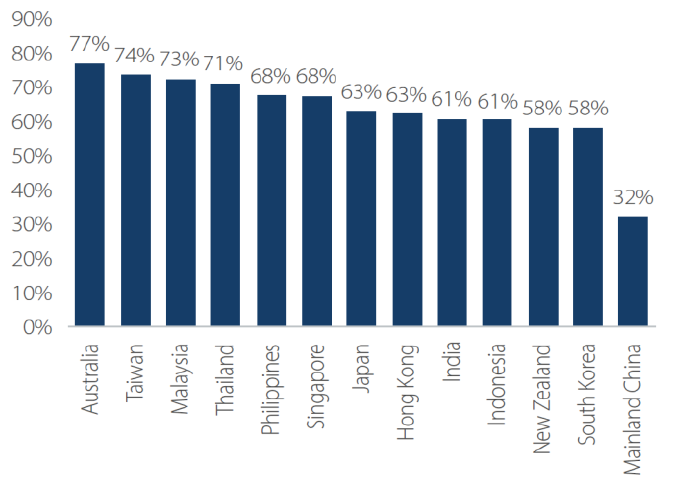

One of the biggest challenges – and indeed pitfalls – within the investment industry is the availability, integrity and relevance of ESG-related data. In many respects, some parts of Asia are still at an early point in terms of disclosures. The chart below shows average environmental and social (E&S) disclosure rates across different countries in Asia.

Figure 2: Average E&S disclosure rate across different countries (MSCI ACWI) – February 2023

Source: MSCI, ESG and GS Sustain, December 2022.

While disclosures are helpful in terms of achieving greater overall transparency, it is important to apply caution towards pure data-driven approaches, and to also recognise that disclosures are only as valid as the authorities policing them. Also, ESG data can be gamed (for example, Wirecard had a 100% independent board of directors), while ‘greenwashing’ remains a significant problem for investment managers to be mindful of.

In the absence of data, or using data as just one input among many, an active investment approach – reinforced by a well-resourced, experienced on-the-ground team – with engagement as a core element of the investment process should lead to the most accurate conclusions and unearthing of opportunities.

Key Takeaway

We believe that managing ESG-related issues as an active manager is about understanding industry norms and identifying what matters the most in influencing shareholder returns from an ESG perspective. ESG investing will continue to develop, evolve, and mature, with investors also adapting how they integrate ESG into their investment processes.

In a time of significant change, Nikko AM is deeply committed to our focused and rational ESG framework, as we are convinced that this best serves our duty as stewards, not only of our clients’ capital but also for the earth and its communities.

To learn more about ESG investing in Asia, download Nikko AM’s new Asia equity investment guide here.

For any questions in regards to this report, please contact:

Nikko AM team in Europe

Email: This email address is being protected from spambots. You need JavaScript enabled to view it.