Summary

- The MSCI AC Asia ex Japan Index slumped 6.8% in US dollar (USD) terms, giving up its January gains. China’s reopening and peak interest rates euphoria in January were short-lived as hotter-than-expected economic indicator releases in the US raised the spectre of higher-for-longer interest rates.

- China (-10.4%) gave back January’s gains amid rising diplomatic tensions with the US. Hong Kong (-7.1%), South Korea (-7.0%) and India (-4.6%) tracked the region’s downturn, while all ASEAN markets turned in negative returns for the month. Indonesia (-1.0%) and Taiwan (-1.1%) were the most resilient Asian markets in February.

- For China, we retain a positive view on areas of consumption, in particular local brand leaders, and on areas of healthcare, software and select industrials. We are in the wait-and-watch mode in India, while our focus on ASEAN remains in the electric vehicle supply chain.

Market review

Asian markets lose momentum and fall sharply

After charging higher at the start of 2023, Asian equities lost momentum and fell sharply in February, with the MSCI AC Asia ex Japan Index slumping 6.8% in US dollar (USD) terms. Gains unravelled over the month as hotter-than-expected economic releases in the US, including data on labour market and consumer spending, led investors to shift their expectations on inflation and monetary policy. Market risk aversion took hold during the month on fears the US Federal Reserve (Fed)'s monetary tightening may last longer than expected.

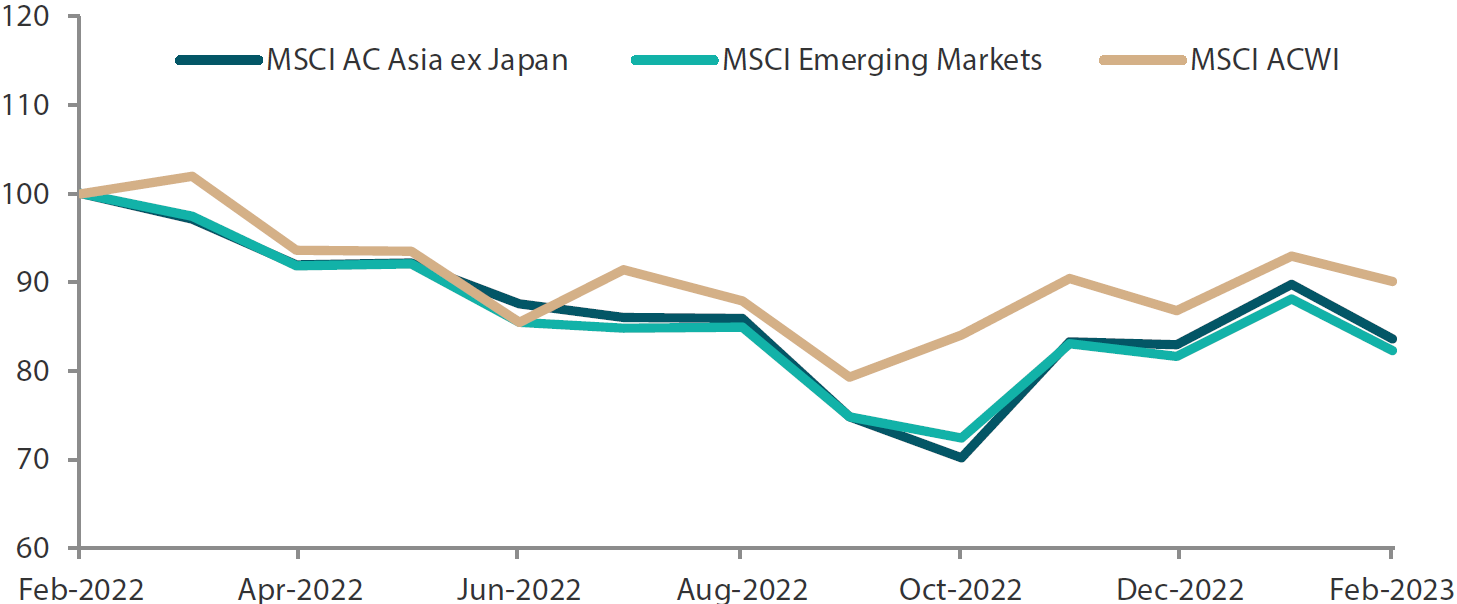

Chart 1: 1-yr market performance of MSCI AC Asia ex Japan vs. Emerging Markets vs. All Country World Index

Source: Bloomberg, 28 February 2023. Returns are in USD. Past performance is not necessarily indicative of future performance.

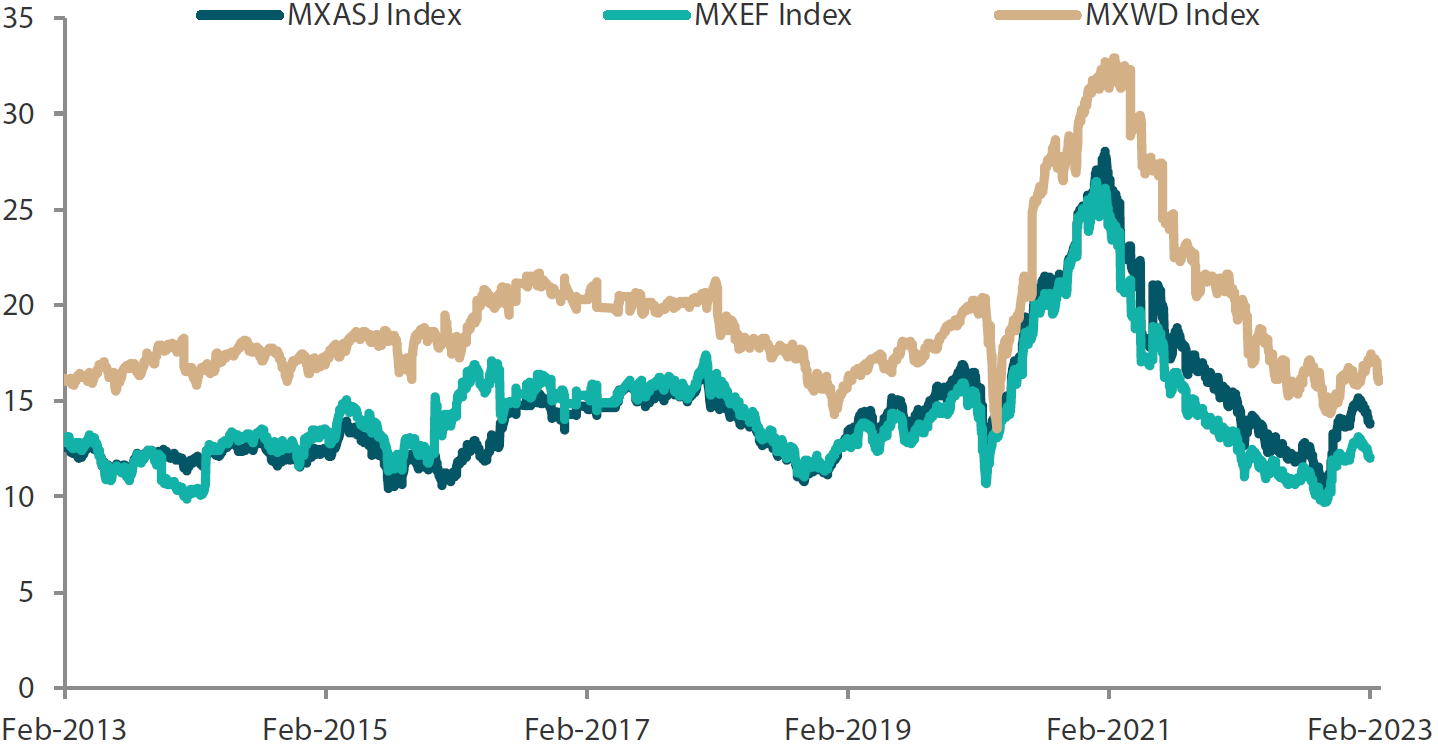

Chart 2: MSCI AC Asia ex Japan vs. Emerging Markets vs. All Country World Index price-to-earnings

Source: Bloomberg, 28 February 2023. Returns are in USD. Past performance is not necessarily indicative of future performance.

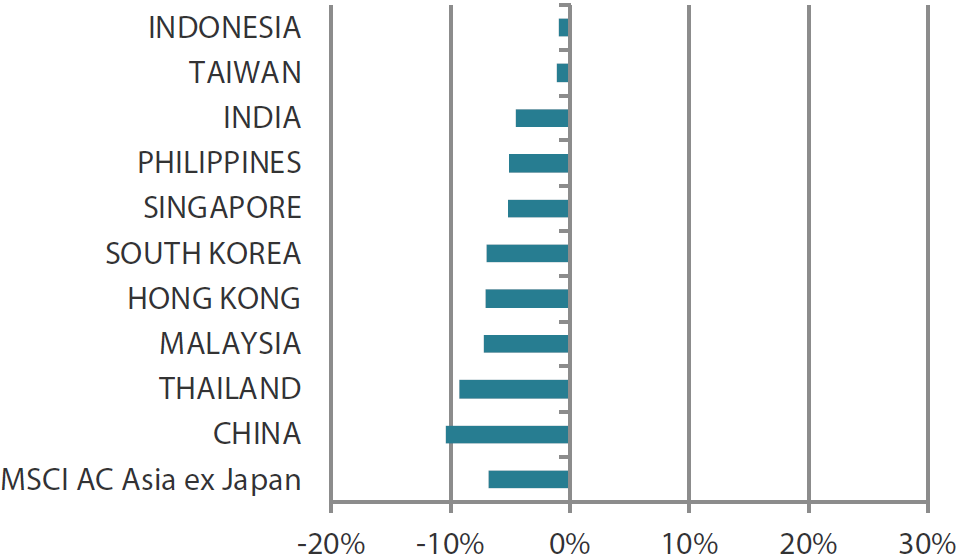

China nosedives; Taiwan among the most resilient Asian markets

In the North Asian region, China (-10.4%) gave back January’s gains amid rising diplomatic tensions with the US, after the uproar over an alleged spy balloon, which was eventually shot down by the US military. China’s January consumer price index (CPI) rose 2.1% year-on-year (YoY) from 1.8% in December, as the Lunar New Year holiday spurred demand following the nation’s reopening. The People’s Bank of China maintained its one-year and five-year loan prime loan rates, widely in line with expectations. Hong Kong (-7.1%) unveiled its budget, with measures to boost economic recovery after the COVID-19 pandemic, as well as incentives to aid businesses and residents.

Taiwan (-1.1%) was among the most resilient Asian markets in February after index provider MSCI said it had increased the country's weighting in the MSCI All-Country Asia ex-Japan Index by 0.03 percentage points to 15.79%. Exports from Taiwan dropped by 21.2% YoY to USD 29.42 billion in January, the biggest fall since 2009, amid weak global demand for technology products. The export-centric South Korea stock market slumped 7.0%, weighed down by disappointing trade numbers. Trade deficit in January reached a monthly record high of USD 12.69 billion, nearly tripling the previous month’s figure, as exports slid 16.6%. Shipment of semiconductors plunged 44.5% in January due to a slump in global semiconductor demand.

All ASEAN markets in negative territory; Indonesia outperforms

In the ASEAN region, all markets posted negative returns for the month. Thailand (-9.2%) and Malaysia (-7.2%) led the decline, whereas Singapore (-5.2%), the Philippines (5.1%) and Indonesia (-1%) fared relatively better. Thailand’s economic growth slowed more than expected in 4Q22, as slumping exports overshadowed the resurgence in tourism. Malaysia unveiled its revised budget, focusing on sustainable economic growth, institutional reforms and reducing social inequality. Singapore also delivered its 2023 budget, increasing handouts to citizens while raising taxes on higher-value property and large multinational firms. In the Philippines, the Bangko Sentral ng Pilipinas lifted its benchmark rate by 50 basis points (bps) on the back of elevated domestic inflation. Indonesia was the region’s best performing market after the country’s inflation slowed to a five-month low, affirming Bank Indonesia’s stance that no more rate hikes are required for this cycle.

Indian equities retreat

India (-4.6%) registered another monthly decline in February. The country’s GDP growth slowed further to 4.4% YoY in the October–December quarter, driven by a continued weakness in the manufacturing sector, along with easing private consumption demand. Indian Inflation printed 6.25%, breaching the Reserve Bank of India (RBI)’s upper tolerance limit, prompting the RBI to raise its benchmark repo rate by 25 bps.

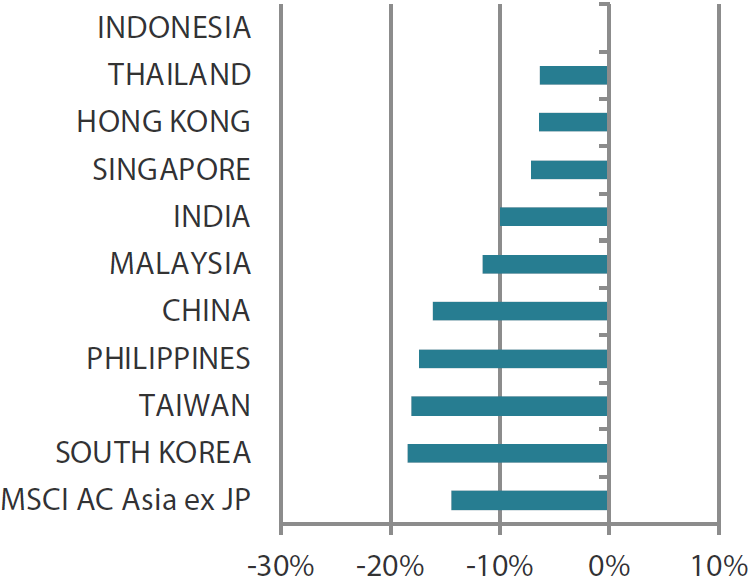

Chart 3: MSCI AC Asia ex Japan Index1

| For the month ending 28 February 2023 | For the year ending 28 February 2023 | |

|

|

Source: Bloomberg, 28 February 2023.

1Note: Equity returns refer to MSCI indices quoted in USD. Returns are based on historical prices. Past performance is not necessarily indicative of future performance.

Market outlook

China offers the best growth opportunities

The China reopening and peak interest rates euphoria in January was short-lived. The Asia ex-Japan market effectively round-tripped in February, giving up its January gains. Reopening in China has boosted the economy and the effects will likely be felt later this year. With inflation being more persistent than earlier expected, interest rates expectations have shifted to higher for longer.

Asia’s prospects still look relatively better, in our view, and valuations are still largely depressed across most parts. We believe China offers the best growth opportunities, especially with the government’s focus on spurring capital investment in domestic healthcare, technology and industrial supply chains.

With COVID-19 rapidly fading in the rearview mirror, China, with its policy and regulatory initiatives, is rushing ahead to ensure leverage is managed and investments in key industries are encouraged. It is also targeting higher GDP growth. Selectively, positive change resulting in growth is back on the agenda and consumption is high on the priority list. In the last two years, the Chinese populace has built up significant excess savings. We expect this stash of money to start finding its way to the equity market, discretionary spending like travel, and slowly back into the property market. For now, we retain a positive view on areas of consumption, in particular local brand leaders and on areas of healthcare, software and select industrials.

Not much has changed in our outlook for South Korea and Taiwan. We have a favourable view of companies that are weighted towards foreign earnings rather than the domestic market.

Adopting a wait-and-see mode in India

Inflation remains an issue in India. The RBI raised rates again to 6.75%, and the higher rates are putting stress on some parts of the lending market. The Adani companies have gone on the offensive with a global roadshow. We remain in a wait-and-see mode in India, looking for investments with positive change and attractive valuations.

ASEAN’s focus remains in the electric vehicle supply chain

ASEAN had a muted January and reversed its gains with a muted February. Our focus remains on investments in the electric vehicle supply chain, which is mostly in Indonesia. We do not see much positive change in the Philippines, Malaysia or Thailand and continue to watch those markets.

Fertile ground in Asia to pick good long-term investments

At present, we find ourselves sandwiched between the prospect of further tightening and potential recessions in the West and the reopening momentum from China—the world’s second largest economy. China is now a bigger trading partner with most countries in Asia than both the US and the EU combined. Hence, for the time being, Asia’s prospects look relatively better and with valuations still largely depressed across most parts, we believe that from a long-term perspective, it will become fertile ground for both high potential sustainable returns and positive fundamental change. China remains the focal point at present, but we would expect that to permeate through the region to varying degrees as economic activity picks up.

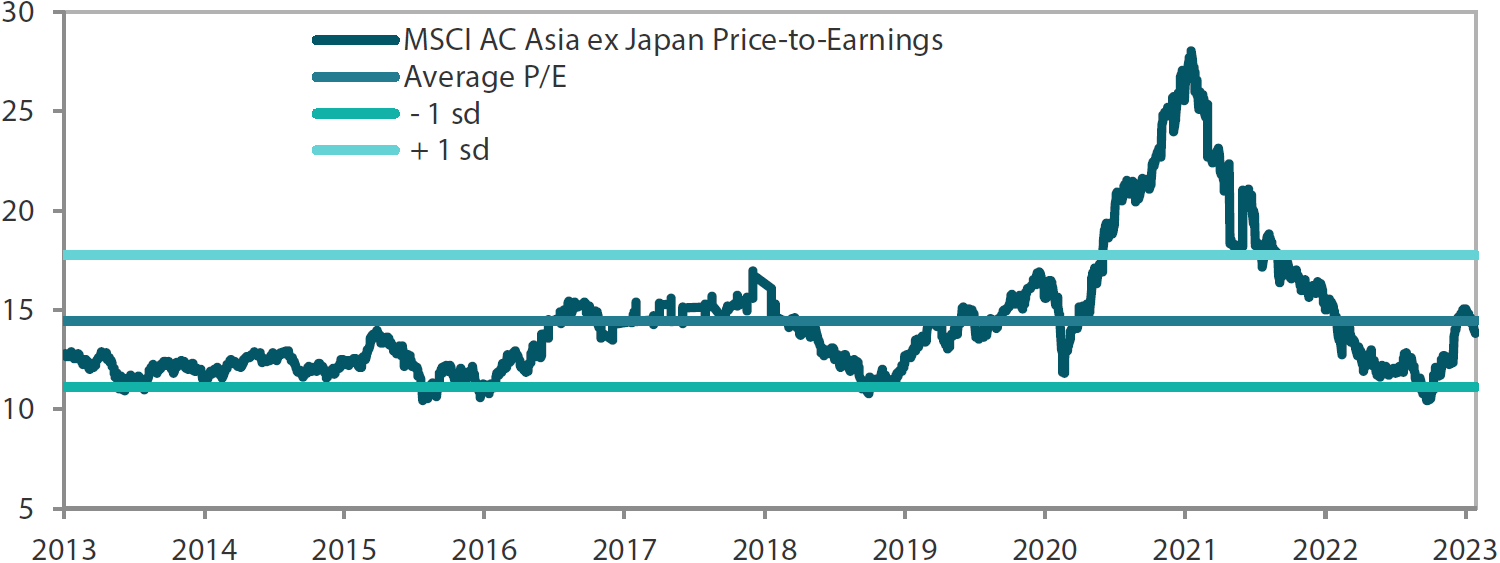

Chart 4: MSCI AC Asia ex Japan price-to-earnings

Source: Bloomberg, 28 February 2023. Ratios are computed in USD. The horizontal lines represent the average (the middle line) and one standard deviation on either side of this average for the period shown. Past performance is not necessarily indicative of future performance.

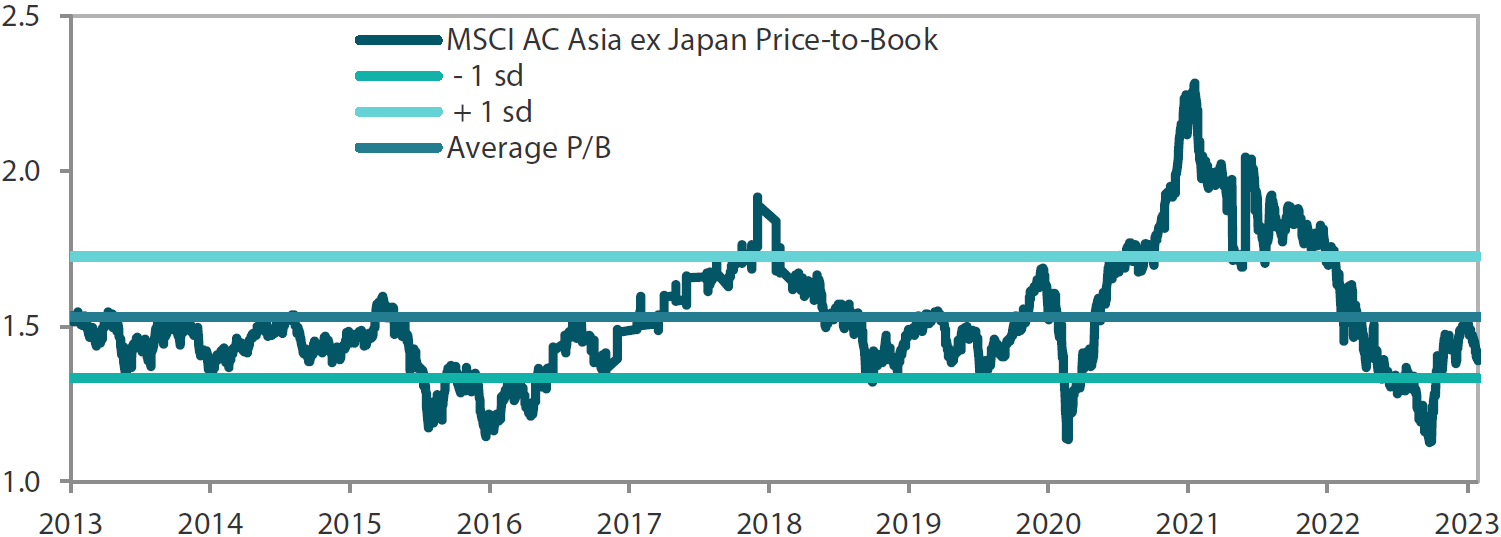

Chart 5: MSCI AC Asia ex Japan price-to-book

Source: Bloomberg, 28 February 2023. Ratios are computed in USD. The horizontal lines represent the average (the middle line) and one standard deviation on either side of this average for the period shown. Past performance is not necessarily indicative of future performance.

Reference to any particular security is purely for illustrative purpose only and does not constitute a recommendation to buy, sell or hold any security or to be relied upon as financial advice in any way.