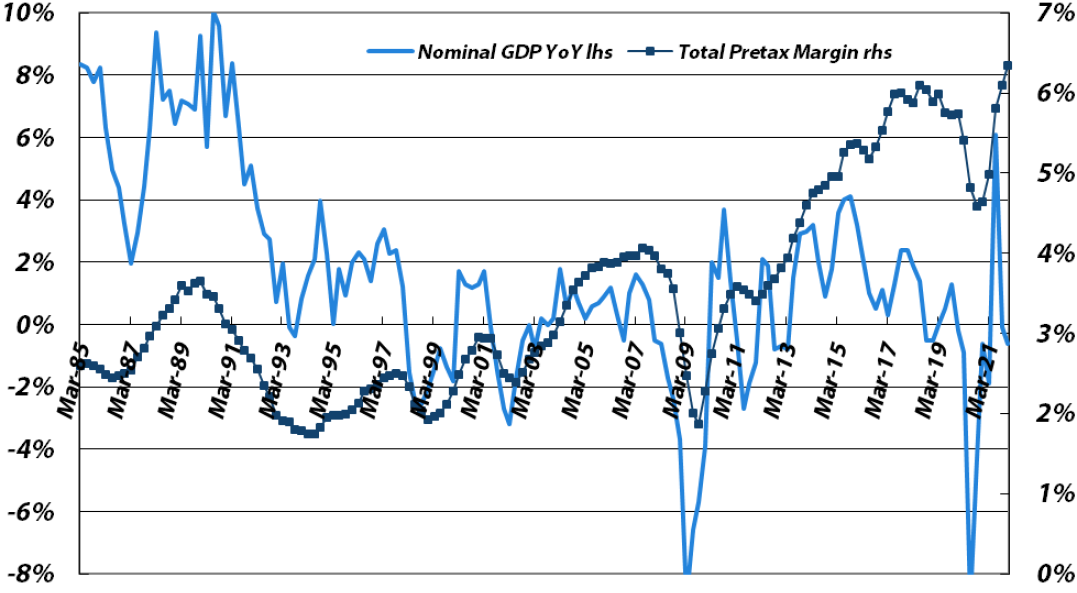

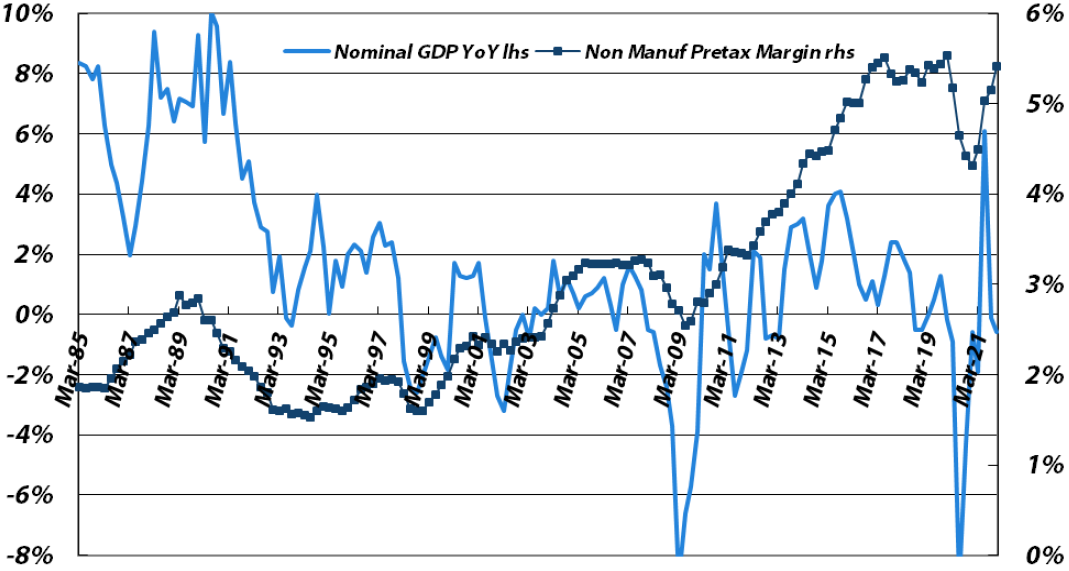

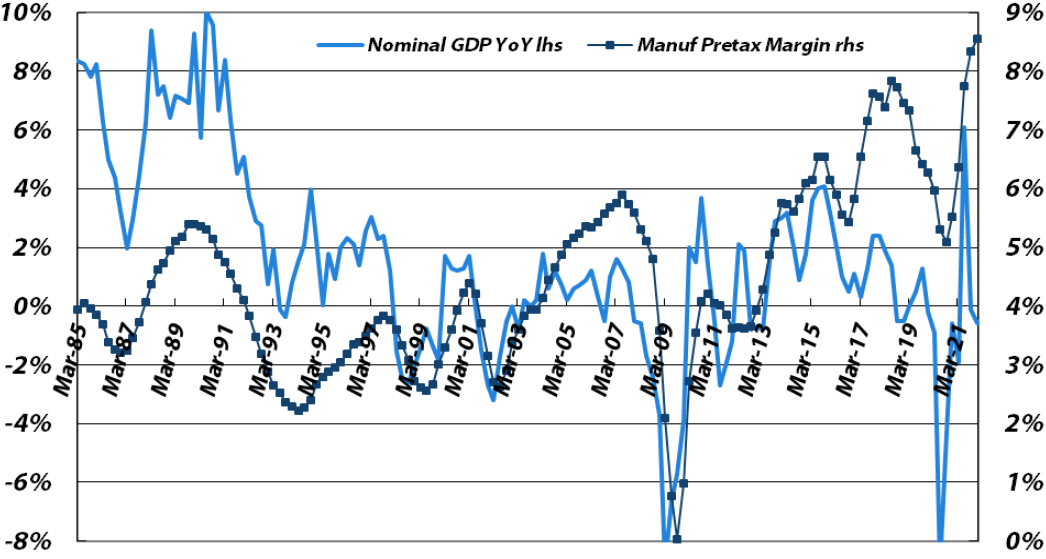

The just released 4Q CY21 data on aggregate corporate profits in Japan was very positive, with the overall corporate recurring pre-tax profit margin hitting a record high on a four quarter average. Both the non-financial service and manufacturing sectors contributed, with the latter surging to another record high. Note that the strong results occurred despite quite weak GDP, further proving the long-held theme of this report that profit margins remain on a structural uptrend despite sluggish domestic GDP growth, as shown in the charts below. Increased pricing power, coupled with improving corporate technological prowess and efficiency, should be credited for this, but strong global economic growth certainly was also a major factor.

Four-quarter Average Pretax Profit Margin vs. Japanese Nominal GDP YoY Growth

(for all non-financial companies, not just listed ones)

Sources: Japan Ministry of Finance, Bloomberg, data through CY4Q21

Sources: Japan Ministry of Finance, Bloomberg, data through CY4Q21

Non-manufacturers (excluding financials):

Manufacturers

Sources: Japan Ministry of Finance, Bloomberg, data through CY4Q21

Sources: Japan Ministry of Finance, Bloomberg, data through CY4Q21

One should also note that the Ministry of Finance statistics cited in this report do not cover post-tax income, and due to corporate tax cuts a few years ago, the overall net recurring profit margin (which is unfortunately unpublished) has expanded even more sharply than the pre-tax data shown above, allowing shareholders to benefit from higher dividends and share buybacks. Also due to buybacks, EPS has been (and still is) growing even faster than net profits.

As for dividends, they have risen rapidly too, more than doubling since 2013 for the Tokyo Stock Exchange Index. Crucially, in order to stabilise Japan’s future, an equity/dividend culture must be better established among retail investors in Japan. There have been gradual image improvements for equity investing since the speculative burst of the 1980s bubble, but achieving a structurally higher dividend payout ratio would be a master stroke as most domestic retail investors don’t accept buybacks as a primary reason to invest long-term in Japanese equities whereas they cherish dividend income, especially given prevailing flat or negative interest rates. Clearly, much progress has been made regarding dividends in the past few years, but much more is needed on this front.

As for the corporate view on dividends, even the most reluctant would now likely agree that their prior resistance to corporate governance reform was unwarranted and should realise that holding excess cash is equally unwarranted now and that Japan’s dividend payout ratio is rather low by mature country standards. Unfortunately, many corporations prefer buybacks to dividends for exactly the wrong reason: dividends are sticky and hard to cut, whereas buybacks can drop to zero with minor embarrassment. But this argument implies to current and potential shareholders that these Japanese companies have little confidence in their future, which is somewhat embarrassing and likely far too conservative. Indeed, in order to be effective as a support for share prices, dividends need to be communicated as being maintained at a high level even in a recession, barring grave financial threats to the company. This should protect the Nikkei from falling too far during troubled times and reduce fearful volatility in the long-term. Such would crystallise the domestic equity culture that Japan has long-tried to instil, just like most of the rest of the developed world, and also would entice foreign investors back into Japanese equities.