Global economic recovery: more inflationary, central banks more hawkish than consensus

Out of the six scenarios presented, a narrow majority of our committee agreed again on a positive scenario in which the global economy matches the market consensus for solid growth, while equities continue to rally. Although we realize that variants present some risk, we estimate that vaccine distribution will, overall, prevent major lockdowns and, thus, continue to heighten optimism among investors, as will geopolitical risks not hampering economic activity. Meanwhile, we continue to expect the US Congress to pass additional fiscal stimulus via various compromises, leading to a mollified version of the Democratic agenda. However, due to increased global supply chain problems and electricity shortages in China (that will likely continue for many months), we now expect the economic recovery to experience higher inflation than consensus expectation, and thus, more hawkish global monetary policy.

In our June meeting, we expected GDP growth for the G-3 and China in 2021 to match consensus, but they moderately underperformed due to various problems, including virus related shutdowns in China, Japan and ASEAN, and many global supply chain problems. We also expected inflation to remain under control, and while prices surged in certain sectors, many (but far from all) were due to accident-related supply problems; however, these problems continued longer than expected, so inflation worsened. We now expect inflation beyond this year will remain high, but the 6-month annualized rates should significantly decelerate. Also, although “transient” remains an applicable term, there has been a large, mostly permanent step-up in overall consumer prices, which is particularly burdensome for low to middle-income households, and inflationary psychology has taken hold to a significant degree. Importantly, however, we expect virtually all this inflation to be driven not by raw material prices, but by services, including housing rents, and by finished goods prices not falling back like many expect.

Our new scenario predicts that globally, GDP will match consensus, with the US up 4.9% at a Half on Half Seasonally Adjusted Annualized Rate (HoH SAAR, as used in all references below) in the 4Q21-1Q22 period and 3.4% in the 2Q22-3Q22 period. Personal consumption should remain strong (after a 3Q shortage-related hiccup), especially in the re-opening services sectors, while private capex should continue to improve in most sectors (also after a 3Q hiccup). Construction spending outside of the infrastructure sector will likely be constrained, but government spending should contribute to grow due to the Democratic agenda, while net foreign trade will likely subtract from GDP growth.

After a virus-constrained 1H, Eurozone GDP grew sharply in the 3Q and should grow 5.2% in the 4Q21-1Q22 period and 2.8% in the 2Q22-3Q22 period. Japan’s 3Q was hurt by virus/vaccine issues (heightened by the burden of hosting a safe Olympics) and supply shortages, but should grow 3.2% in the 4Q21-1Q22 period and 2.5% in the 2Q22-3Q22 period. Deep consumer fears shifting toward optimism should be particularly pronounced in these two regions, with business confidence also boosting capex to a large degree, especially to solve supply chain issues and improve climate-related mandates. Japan’s economy should, in particular, benefit greatly from continued global tech demand and a rebound from hampered auto production.

For China’s economy, we expect that it will be able to wade through the current troubles, although it may be quite rocky at times. The country has changed direction and such transitions can be very difficult, although often rewarding. Clearly, the real estate industry could not continue to be relied upon for economic growth forever. Decreasing the gearing-risk of the property companies certainly makes sense, as it will curtail overall financial industry risks, but such will create occasional potholes in what is an extremely opaque and complicated, yet important system. The leadership there likely wishes they had started these efforts earlier, but this process has been years in the making and they seem intent on maintaining the course, confident that they can prevent systemic risk and major negative wealth effect by consumers and corporations. A key question is whether a large number of vacant apartments will be either rented out or sold. Although the former would reduce rents, matching the common prosperity theme, (and coupled with a major government drive to build rental housing), the latter might depress property prices too much.

Meanwhile, the regulatory crackdown on various sectors aims to reduce inequality and veer the culture away from trendy (usually foreign, including Asian) and gaming cultures. Growth in the social media sphere will be moderately curtailed for an indefinite period, but will still likely grow nonetheless. Meanwhile, China is promoting super-high technology fields so as to achieve self-sufficiency in semiconductor production equipment (which will be extremely difficult, as no country has ever achieved such) and other areas where China already has achieved prowess like AI, systems integration and the medical industry. It will also likely try to keep as much foreign business involvement as possible (as long as such does not get political), as such will be needed to support the economy.

Finally, as for the broader outlook, GDP for the US, Eurozone, Japan and China should match consensus of 5.9%, 5.3%, 2.3% and 8.0%, respectively, in CY21, and 4.2%, 4.3%, 2.7% and 5.4% in CY22. All these numbers are boosted by low base effects, however.

Non-economic factors always concerning but not significantly impactful

There continue to be, as always, valid reasons for concern about many geopolitical issues, especially regarding North Korea, China and the Middle East. Relations between the West and China remain very tense, but neither side seems willing to cross any red lines, although the blacklistings of certain foreign businesses certainly ratchets up the potential for major economic disruptions. Increased fears about Taiwan certainly should not be ignored either. The G-7’s addressing of concerns in China, including the investigation of the origins of the virus, may trigger continued retaliation and the recent EU-China investment pact is likely in jeopardy, while the increased chance of many countries boycotting official attendance of Beijing’s Olympics would increase tensions even further. Meanwhile, the Middle East remains risky, especially whether the Iran deal will be completed, as Israel’s patience has virtually disappeared.

We still expect that any additional stimulus bill will require the “reconciliation” method, which, due to the influence of moderate Democrats, will likely constrain the size of the stimulus and require significant tax hikes. For non-budgetary items, Biden will be less constrained; indeed, he will need to satisfy his left-wing by extensively issuing executive decrees and regulatory mandates to achieve the Democratic agenda (although some of these have already been at least partially blocked by federal judges and more are likely to be so). The net result of this political change, especially if it includes tax hikes, should make risk markets and business leaders wary in some US sectors, but such will likely boost the economy in some sectors, particularly in the new energy and technology fields.

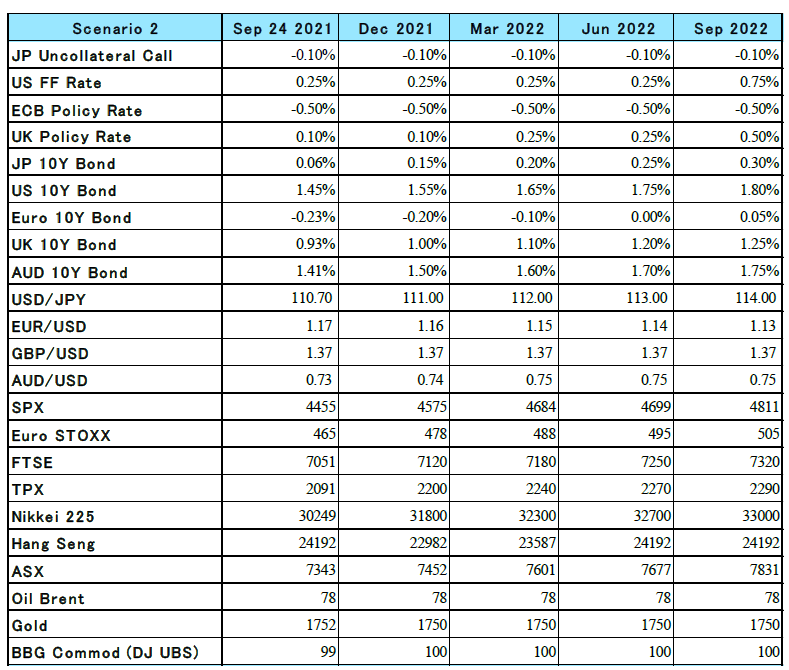

Our detailed forecasts:

Source: Nikko Asset Management

Source: Nikko Asset Management

Central banks: more hawkish than consensus

For the reasons stated above, we bring forward our Fed tapering initiation from December to November and now expect it to end tapering by April, which is earlier than the mid-2022 consensus. In June, we expected it to guide the market for mid-2023 rate hikes, but now we expect such in the 3Q22, much earlier than consensus. As for the ECB, we expect it to end its PEPP program as scheduled, which would be considered moderately hawkish, and also guide for APP QE tapering completion by the 3Q22, with rate hikes in starting in 4Q22. Meanwhile, the BOJ is likely to remain on hold, but with a few minor tweaks and with less dovish rhetoric, especially if the yen substantially weakens (and the converse, if such occurs). In sum, however, although this hawkishness may give markets indigestion for a while, policy will remain extremely accommodative.

One of the biggest monetary questions regards the replacement of all top three Fed positions. Although it seems that Powell is keen to remain in the job, he will be increasingly swayed by more dovish members on the board. Lael Brainard will likely be asked to become Vice Chair for Supervision and she is firmly in the Democratic Party and, thus, tilts moderately toward the dovish side, while being much stricter on bank regulation. Meanwhile, the Vice Chair position regarding monetary affairs is held by Richard Clarida, who is a staunch Republican and will likely be replaced when his term expires early next year. The current Vice Chair for Supervision (for the financial sector), Randy Quarles, is also a staunch Republican who will likely be replaced when his position expires in October, although he has mentioned he may stay on as a regular board member (which would be highly unusual). There is also one open general board position, so the Democrats likely need to nominate three D.C. board members, which should occur imminently. Meanwhile, the early retirement of two regional presidents who leaned recently hawkish will likely lead to their replacement (with the D.C. Fed’s leadership input) by their regional boards with doves. There is a strong predilection for diversity, and there are likely several candidates who are likely suitable, especially if the Democrats are willing to accept a candidate for the monetary affairs job from Wall Street. The Democrats, especially from the moderate wing, wish to be very careful about pushing the Fed into an extremely bold progressive mode lest the bond market, especially its foreign investors, lose confidence in the USD; however, an increase in that direction is extremely likely, so it will be interesting to see how markets react. The top positions all have long terms, and can hardly ever be fired, so it will be a long-lasting shift. The effect of much stricter banking regulation, coupled with progressive, including green-oriented, lending mandates, would also have wide ranging implications for the economy and markets.

USD slightly stronger; moderately increasing G-3 bond yields

The US Treasury 10-year yield nearly matched our 1.50% end-September estimate while, our European and Japanese forecasts were also approximately correct. Although strong economic growth with high inflation will be a challenge, coupled with sharply reduced Fed purchases, many bond investors will likely continue to assume that inflation will not be persistent, so we don’t expect yields to surge. Helping in this regard, we expect most commodity prices to stop rising thanks to increased supplies and fewer constraints, as a mostly-vaccinated world learns to “live with COVID.” Bond investors will also worry about the global economy due to the virus, occasional disappointing economic data and problems during China’s transition. Thus, we expect 10-year yields globally will continue to be somewhat pinned down by low central bank policy rates. For US 10-year Treasuries, our target for end-December is 1.55%, while those for 10-year Bunds and 10-year JGBs are -0.20% and 0.15%, respectively, mildly rising by next June to 1.75%, 0.0% and 0.25%. Regarding forex, we expect the USD to be 111 vs the yen in December and 113:USD next June, while it should also mildly strengthen vs the EUR to 1.16 at end-December and 1.14 at end-June.

This all implies that the FTSE WGBI (index of global bonds) should produce a -0.5% unannualized return from our base date of September 24th through December in USD terms and -2.1% through June. Thus, we continue our unenthusiastic stance on global bonds for USD-based investors. For yen-based investors, this index in yen terms should return -0.2% and -0.1%, for those respective periods, with JGBs returning -0.9% and -1.8%, respectively, so the case for preferring offshore bonds looks clear for the next year.

The front month Brent oil price was about flat, just as we forecasted, remaining high with increased (though somewhat paltry) production by OPEC+, continued global economic growth, and continued low US production (hit even harder by Hurricane Ida). However, the Iran question looms large, both geopolitically and as regards global oil supply. The acceleration away from oil toward alternative energy sources should calm oil prices. Our Brent forecasts are USD 78 at end-December and March, virtually the same as the present level.

We expect that headline and core CPI measures will remain very high on a YoY basis, at 5.8% and 5.6%, respectively in March (vs. consensus of 3.0% and 2.9%) and 3.7% and 3.5% (vs. consensus of 2.3% and 2.4%), respectively, next September, but on a 6-month annualized rate will decelerate to 2.2% and 2.4%, respectively, in September. Headline would need to grow 0.35% per month to reach the March level, and although it is very difficult to know how housing rent will be measured, we expect it to be much higher than many expect (most survey show rents soaring in recent months), which will be the major driver of excess inflation. We also doubt that new car prices will decline much and that finished goods prices, both imported and domestic will remain high due to various shortages and logistics issues (including rapidly increasing distribution costs globally and internally). Lastly, corporations seem to have huge pricing power and use shortages to rationalize price hikes that are higher than needed to maintain current profits. The Biden Administration criticizes price hikes occasionally, but we see little concrete action so far, or up ahead.

Similar surprisingly upward increases in CPIs in Europe and Japan should also occur, in our view; thus, the global recovery will be inflationary, as intended by central banks. Let’s hope that this does not hurt income inequality more than it helps it.

Global equities should continue upward, especially Japan

Our positive, near-Goldilocks scenario, stance on overall global equity markets in our June meeting was quite successful until the end of September when weaker markets and a stronger USD erased nearly all MSCI World Index gains (including dividends) in USD terms. Japan greatly outperformed the world (although this was merely catching up most of its recent underperformance), as we expected, but Developed Asia Pacific severely underperformed the globe (and our forecasts). Surging CY21 EPS estimates after strong 2Q earnings seasons globally were offset about inflation fears and global investor fears about the multiple problems in China. Our new scenario forecasts a solid return for global equities in the 4Q, especially on an annualized basis, and further gains in the following quarters too. Moderately higher taxes ahead for the wealthy, and perhaps for all equity investors too, in the US will hamper investment sentiment, but increased US fiscal spending and the global vaccine-driven economic and corporate earnings recovery should more than offset such. The lack of geopolitical events that hurt market sentiment should also support prices, although we admit to “crossing our fingers” on the Iran deal. Moreover, a major positive factor should be 3Q earnings and their impact on CY22 expectations. The last five quarters’ US earnings seasons were astonishing, with many companies beating consensus “by a mile”. The CY21 SPX EPS estimate rose about 6% during the 3Q, after 8% in the 2Q, summing to an astonishing 23% YTD revision. If, as we expect, 3Q EPS forecasts sharply exceed consensus, analysts will have little choice but to be even more enthusiastic in their CY22 forecasts. Thus, although PE ratios look high, the upside to CY22 earnings estimates will likely make valuations much less expensive. We continue to cite the mantra: “the ability of US corporations to beat profit expectations, especially on an adjusted basis, is very impressive and should not be doubted going forward, even under difficult circumstances.”

Japan and Europe also greatly exceeded earnings expectations in the 2Q after a strong showing in the previous two quarters. Surprising to most investors, they both actually beat the US in this regard. Japanese analysts tend to be quite conservative and corporate managements, upon which sell-side analysts highly rely, often guide earnings too cautiously. However, analysts’ CY21 earnings expectations continued to surge, with TOPIX’s rising by 8% during the 3Q (also a +23% YTD revision in our estimation). Thus, after the 3Q earnings season, analysts will likely be even more confident in raising CY22 EPS estimates. Widespread analyst scepticism was also greatly alleviated in Europe despite the region’s troubles, with CY21 EPS revised up by 8% during the 3Q, and the strong vaccine-led economic recovery should continue to boost confidence among analysts and managements about CY22 profits. Notably, MSCI Developed Pacific ex Japan’s CY21 EPS actually decreased 2% during the 3Q, although this is partly due to this index being measured in USD terms while the AUD depreciated in the period.

In sum, we retain our usual enthusiastic view on global equities. Aggregating our national forecasts from our base date, we forecast that the MSCI World Total Return Index in USD terms will rise 3.0% through December, 6.5% through June and 9.0% through next September (3.3%, 8.7% and 12.2% in yen terms). We expect positive returns in each region, with Japan’s the highest in nearly all timeframes.

In the US, the SPX’s PER on its CY21 EPS estimate is now about 22, which remains, by historical standards, very high. Its CY22 PER is also a bit high at about 20.0. However, there are clear reasons for such: fixed income yields are low (and long bonds total returns should be low), buybacks are rebounding sharply (with banks now allowed to accelerate such) and earnings growth should exceed the already strong consensus view. The wild valuations among some small speculative stocks is mostly a sideshow and indeed, it has been “the wild west” in some parts of the market, so financial regulators are increasingly intervening against such; not harshly yet, but such could increase. However, interestingly, Democrats seem unwilling to disturb Wall Street, while also hoping for asset revaluation, just like Republicans, to aid the economy and, thus, their political approval rating. Government intervention, especially on merger and anti-trust concerns, especially among major tech stocks, is also likely to be a moderate headwind. In sum, we expect the SPX to rise to 4,575 (3.1% total unannualized return from our base date) at end-December, 4,699 at end-June (6.5% return) and 4,811 next September (9.3% return), with yen-based returns being even higher.

European equities underperformed the US in USD terms, but the weak EUR was a clear factor. Europeans’ confidence in their intermediate-term economic future should continue to improve due to vaccinations, while the global economy surpassing consensus should also improve investor, business and consumer sentiment. The PER at 16.6 times CY21 EPS is not low compared to its history (CY22 PER is about 15.6), but as mentioned above, we expect EPS to be revised upward. The high market dividend yield, especially now that most dividend cuts seem finished and hikes will likely be allowed for banks, should also continue to attract domestic and global investors. Thus, we expect the Euro Stoxx index to rise to 478 at end-December and FTSE to 7,120, which translates to a return of 2.3% (unannualized from our base date) for MSCI Europe through then in USD terms. We project even better MSCI Europe returns through June, at 5.4%, and at 7.2% through next September. As for a “known unknown,” it will be interesting to see how the markets react to the developing outlook for German political leadership this autumn, which will likely shift significantly to the Left.

Japanese equities excelled after a disappointing 2Q. Optimism rebounded from the slow (but now rapid) vaccine distribution in the 2Q and related shutdowns (heightened by the Olympics consideration). However, as mentioned earlier, its CY21 EPS estimates rose very sharply, partly due to benefitting from the global tech cycle, in which Japan holds many leadership positions, especially in the booming sector of semiconductor producing machinery. Meanwhile, Japan has low political risk and structural reform is continuing, especially in digitalization and alternative energy. TOPIX’s PER fell to 15.4 times its CY21 EPS consensus estimate, which is much lower than other regions, and here too, earnings estimates will likely be marked up. Items that will boost the market should be Japan’s significant post-emergency 4Q GDP rebound, increased share buybacks, strong global GDP growth and the significant alleviation of component shortages in auto and tech production.

Notably, the market’s dividend yield is highly attractive, even by global standards. We expect domestic investors, once the virus fear is overcome, to return to the equity market in large fashion, based upon dividend income. Indeed, the accentuation of the equity culture here should be driven by the realization that the 1987-2012 period does not provide the proper example for Japan’s intermediate-term future now that the country has greatly reformed. In particular, continued improvements in the global semiconductor and smartphone cycles and rapidly improving global demand for capex goods should boost earnings and, thus, incentivize investors, to return to Japanese equities. The auto sector’s fortunes troubled in the short-run, as shortages have been even worse than expected, but the sector outlook remains positive in the intermediate term given its technological proficiency. Meanwhile, the Olympics and Paralympics proceeded well, as we somewhat boldly always predicted, and Japan was globally lauded for hosting it during troubled times. As for the upcoming general election, the LDP will likely greatly prevail due to a younger, more female cabinet, coupled with all the economic and social improvements. This should lead to investor perception of continued political stability, perhaps even before the election, due to polls likely showing strong support after the cabinet is formed. Overall, we expect TOPIX to rise substantially to 2200 at end-December, 2270 at end-June and 2290 by next September for total unannualized returns of 5.4% in USD terms (5.7% in yen terms), 7.7 (10.0% in yen terms) and 8.2% (11.4% in yen terms), respectively, from our base date through those periods. As for the Nikkei, it should hit 31,800, 32,700 and 33,000, respectively. These returns are obviously attractive for both domestic and global investors.

Developed Pacific-ex Japan MSCI: clearly, this zone is heavily affected by China and we failed to see its harsh measures associated with the virus, the shortage of coal leading to electricity rationing and most of all, the extent of the real estate problems. But not all is lost, as most of the economy continues firm and GDP should grow over 8% this year (although off a low base). Although the Biden Administration has maintained Trump’s tough actions on China, it will likely seek to retain current trade relations and accept the multipolar global construct. In fact, there is a major chance that it will eliminate many of Trump’s tariffs fairly soon too. However, China’s recent party-led boycott of Western firms that have expressed human rights concerns ratchets up the trade pressure, as do other tensions with global democracies, including relations with Taiwan. Australia’s relations with China are still very poor, but the country is benefitting from strong global demand for commodities like metals, LNG and coal. Hong Kong’s stock market, which is dominated by PRC firms, was hurt by several of China’s developments, but residential property prices continue to rise (although there is now clear guidance from the PRC that high prices are bad for equality). Clearly, vaccines and increased global tourism will eventually help these two economies tremendously, but the 3Q was very disappointing in this regard. In sum, we are cautious on Hong Kong for the next six months, with some rebound after that. Australia looks very strong to us, however. Our targets for the Hang Seng are 22,982, 24,192 and 24,192 at end-December, end-June, and next September respectively, and the ASX at 7,452, 7,677 and 7,831, leading to the region’s MSCI index in USD terms to rise (total annualized return) 1.3%, 7.6% and 9.9% for those periods.

Investment strategy concluding view

The global economy should match the consensus for strong growth, thanks to vaccinations, continued fiscal stimulus, acceptable global geopolitical conditions, and continued low interest rates despite increasingly hawkish central banks. This, via increased corporate profits (with seemingly unstoppable corporate pricing power), should allow equity markets to perform well through December and much of next year, with impressive returns in each region, particularly in Japan. Meanwhile we expect continued poor returns for global fixed income. There remains, of course, a significant chance of alternate scenarios, for which we have different market and economic targets, and institutional investors are welcome to contact us for such.